To learn more about agribusiness in Ukraine, follow us on Facebook, on our channel in Telegram, and subscribe to our newsletter.

VAT cut adversely affected Ukrainian milling business — opinion

VAT reduction on agricultural products from 20% to 14% has had a negative impact on the milling business in Ukraine, Elevatorist.com writes.

It is noted that flour mills sustain losses from the new tax rates for wheat, which were introduced under the Law No. 1115-IX "On Amendments to the Tax Code of Ukraine Concerning the Value Added Tax Rate on Transactions for the Supply of Certain Types of Agricultural Products".

Rodion Rybchinsky, the head of the Association Millers of Ukraine, stresses that the gap in VAT rates between raw material producers and processors will have to be offset against the cost of the flour.

"Today we buy wheat from agriproducers with a 14% VAT, while our tax remains at 20%. That is, the mills have to cover this 6%," he marks.

Alibek Mustapayev, the executive director of Andrushevsky Elevator and Mill Base enterprise of Grain Base of Ukraine, adds that after the new law came into force, processors suggested that farmers lower wheat prices because of the VAT difference. However, agrarians are not willing to take this step, they are confident that the cost of quality food wheat will keep rising through the end of the season.

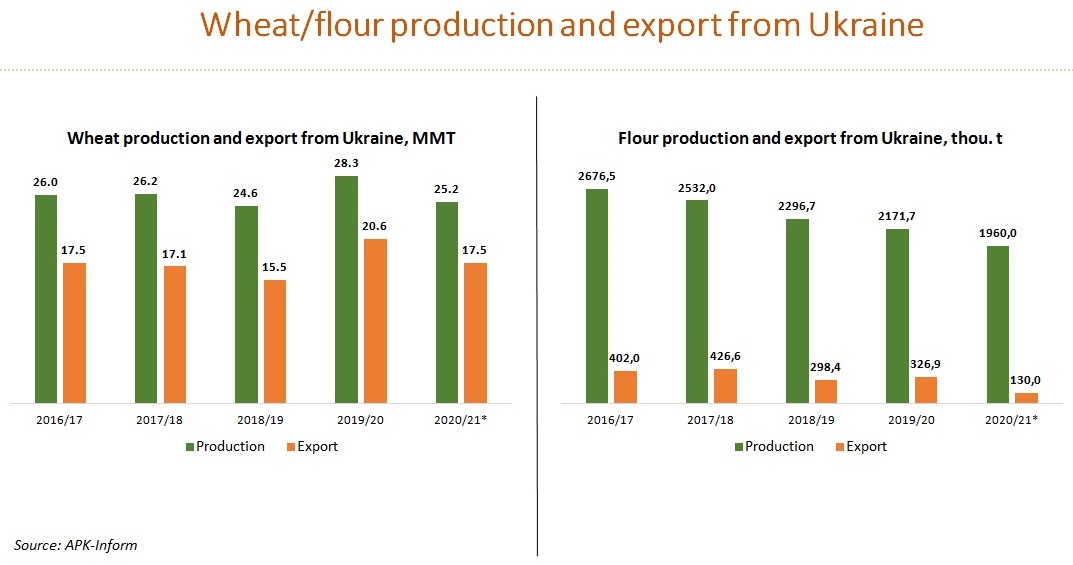

Flour export from Ukraine as of March 15 reached 95.2 thou. t, 64% lower YoY.