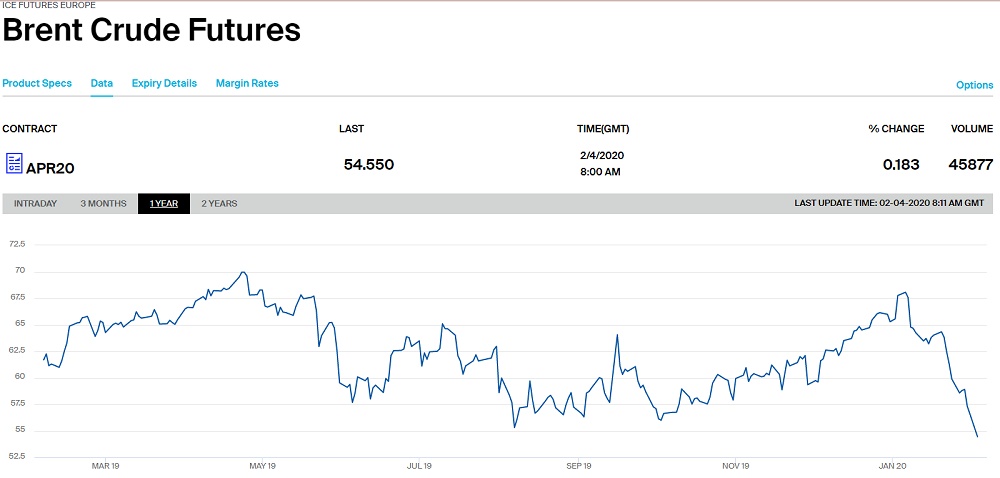

Oil prices dropped to 13-month lowest

Prices of April futures for Brent fell to a minimum level since January 2019 — USD 55 per barrel, Intercontinental Exchange data show.

As reported by Reuters, oil prices fell to the lowest in more than a year on Monday as the coronavirus outbreak curtailed Chinese demand and sparked potential supply cuts by OPEC and its allies.

“We have not seen a demand destruction event of this scale that moves this quickly,” said Phil Flynn, analyst at Price Futures Group in Chicago.

As the outbreak hits fuel demand in China, the world’s biggest crude oil importer, refiner Sinopec Corp (0386.HK) told its facilities to cut throughput this month by about 600,000 barrels per day (bpd), or 12%, the steepest cut in more than a decade, the message reads.

The Organization of the Petroleum Exporting Countries (OPEC) and its allies, a group known as OPEC+, are considering a further 500,000 bpd cut to their oil output, three OPEC sources and an industry source told Reuters.

“The market needs assurances that the supply/demand equation remains in balance for prices to hit a floor. This suggests a commitment from OPEC not just to extend oil supply cuts, but even implement deeper ones beyond March,” said FXTM analyst Hussein Sayed.

Previously reported that crude prices extended declines on Jan. 27, dropping below USD 60 for the first time in nearly three months, as the death toll from China’s coronavirus rose and more businesses were forced to shut down, fuelling expectations of slowing oil demand.