Illusion of Protection Against Ukrainian Grain for Europeans or Future Prospects of Grain Trading

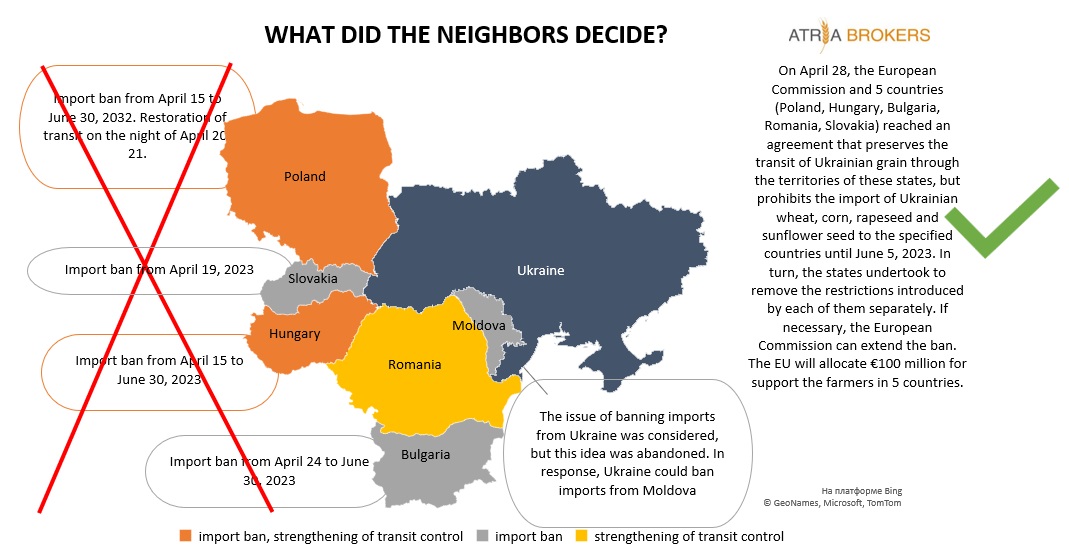

The mass sale of Ukrainian corn with delivery to the borders with Poland and Hungary stopped at the beginning of March 2023 due to the non-competitive price. Almost a month has passed, and since the beginning of April 2023, farmers in Poland, Bulgaria, Slovakia, Hungary and Romania organized mass protests against Ukrainian grain considering it the main reason for the price reduction. It resulted in the import ban for all Ukrainian agricultural products for the period between April 15 and 24, while the farmers have got €100 million in subsidies as part of the second aid package in exchange for a transit regime for Ukrainian wheat, corn, sunflower seed and rapeseed. As a reminder, the first package was in the amount of €56 million for Poland, Romania and Bulgaria. On May 6, Moldova also announced its intention to join the mentioned 5 countries, but already on May 11 softened its dialogue against the background of a possible ban on the import of certain types of Moldovan products to Ukraine. Shadowboxing and the reluctance to accept the fact that the train of high wheat prices has already left leads to the fact that the EU enters a new season with increased wheat stocks.

Boiling points of Ukrainian exporters

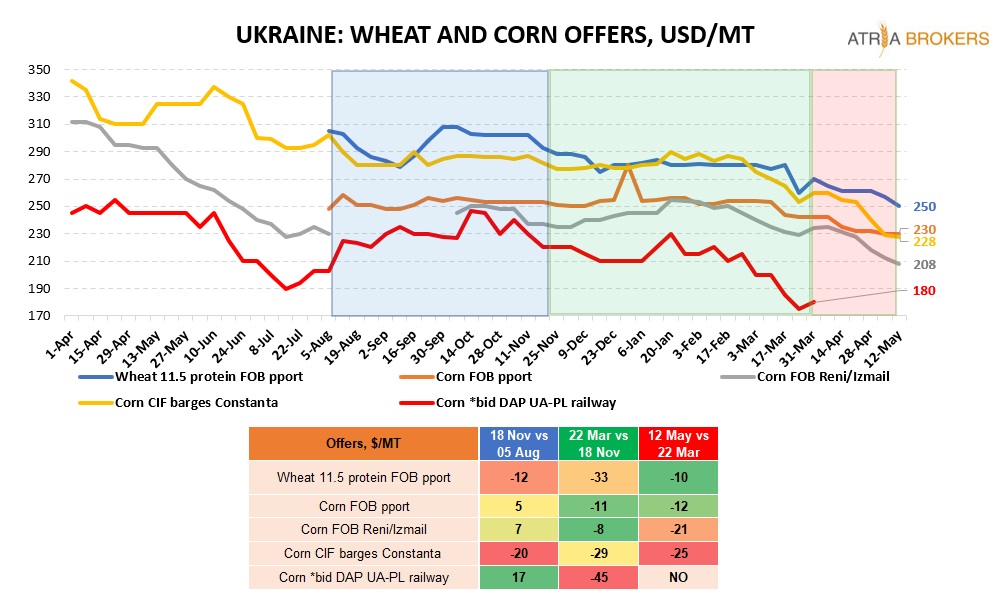

It can be said that the boiling point for a significant slowdown in Ukrainian corn sales at the beginning of March 2023 was the bid price for delivery to Polish and Hungarian borders at less than $210/MT. In the same period, mass sales of sunflower seed to Bulgaria and Hungary slowed down, as the bid price fell below $520/MT. What did Ukrainian traders do after such prices settled?

They rushed to contract for other destinations — deep-water and shallow ports. They continued to fulfil previously signed contracts on the borders, while the import ban and new procedures for transit documentation greatly slowed down the pace of deliveries and resulted in additional expenses, both for Ukrainian exporters and for European importers. All this put additional pressure on the prices of Ukrainian wheat and corn, which, even before all the innovations from European neighbours, could barely find any bullish factors amid the massive supply of russian wheat and the weakened demand for corn from the EU.

The import ban by 5 countries may have a greater impact on the sunflower seed market

The 5 "forbidden" countries for Ukraine had a different significance for the import of each of the prohibited crops. Sunflower seed was mainly processed in Bulgaria and Hungary, so for this crop, the significance of the import ban seems greater. As for corn, the mentioned countries were mainly transit routes with the exception of Hungary, which faced a crop failure in 2022/23 MY, and after the import ban, there was still a need to import about 700 KMT of corn, according to local experts. With wheat, the situation is even clearer regarding the importance of transit.

Does Ukraine discount prices?

After the start of the war in February 2022, the Ukrainian market watches every opportunity to sell at more or less favourable prices. The opening of the grain corridor in July 2022 allowed market players to exhale and become more mobile in the constant rush between sales by vessels via the corridor, vessels via shallow ports, barges to Constanta, cars or railways to ports, borders or to the domestic Ukrainian market.

The sense of hopelessness forced Ukrainian farmers to sell more or less evenly throughout the season in order not to lose stocks physically. In turn, European farmers were able to "sit on the stocks" and monitor Euronext's reaction to the development of military operations.

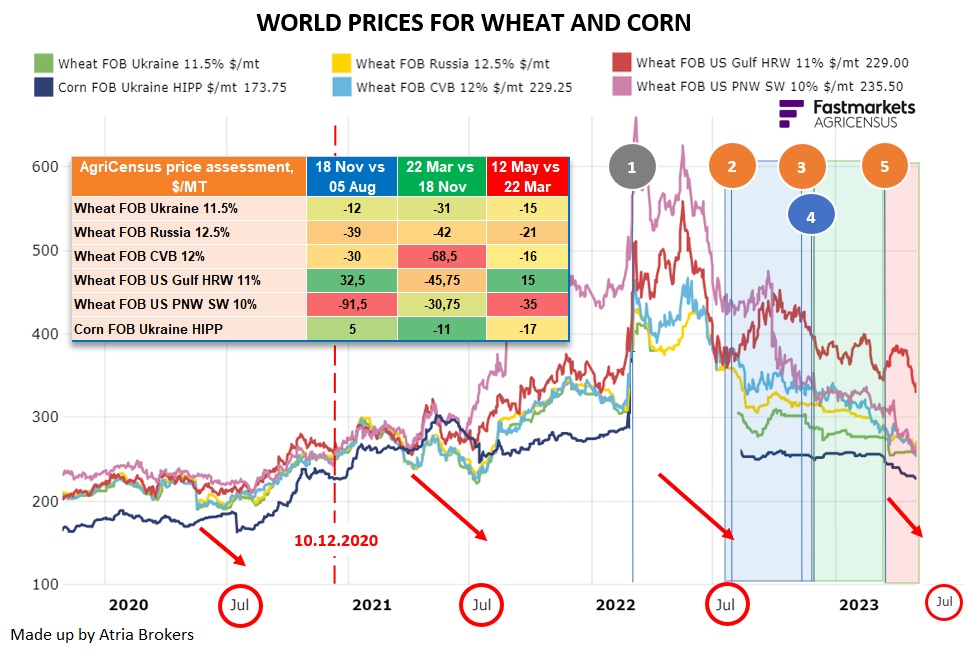

Most of the factors (as well as the war factor) rather quickly exhausted their influence on wheat prices on the world market, as russian wheat was an alternative to Ukrainian origin, the harvest of which reached a record in 2022/23 MY (92 MMT according to May USDA estimate). Due to this pressure, wheat prices in the world returned to the pre-war level by the time of the launch of the grain corridor.

According to AgriCensus, from July 1, 2022, to May 11, 2023, russia exported a record 38.9 MMT of wheat by sea and land, +41% y/y. Thus, russia has already exported 87% of the USDA’s forecast (a record 44.5 MMT according to a May report). Despite this pace, record stocks of wheat are expected in russia by the end of the season.

If in April USDA’s report, the ending stocks of wheat in russia in 2022/23 MY were expected at 14.4 MMT, then in the May report they were increased by 3.25 MMT to 17.64 MMT (due to lower domestic consumption, a decrease in the export forecast, as well as an upward revaluation of beginning stocks). Thus, the carry-overs will grow by 5.5 MMT y/y — the largest increase in the last 10 years.

And the fact that the Ministry of Agriculture of russia introduced a grain export quota for February 15-June 30 in the amount of 25.5 MMT with the possibility of increasing this quota, only states the fact of high exports, not making it smaller than most analysts predict. At the same time, the propaganda emphasizes the saving role of russian cheap grain for the world market during the war started by russia itself. But when it comes to who is discounting prices, the choice of propaganda for some reason falls on Ukraine.

Did Ukraine hinder the European wheat export?

Europe is a traditional competitor of russia and Ukraine in the wheat export market. European farmers expected that during harvesting the prices are traditionally low and will definitely rise later. Moreover, the wheat production of the main European exporters decreased in 2022/23 MY due to unfavourable weather, and this limited price losses for a certain period of time. According to analysts, wheat production decreased by almost 2 MMT in France, by 1-2 MMT in Romania, by 1 MMT in Bulgaria, and halved in Moldova. Poland was an exception, as the crop here increased by about 1.3 MMT.

Are rumours about the closure of the corridor bearish or bullish for prices?

Artem Rozhkov, a broker and co-founder of Atria Brokers, answered this question. He noted that some operators of the Ukrainian market are still considering that rumours about the closure of the corridor should support Ukrainian grain prices. In practice, during the previous two periods of the extension of the corridor, prices for Ukrainian wheat decreased.

During two periods of the corridor (blue and green in the graph), the prices of Ukrainian wheat with a protein content of 11.5% in the Black Sea ports decreased by $12/MT for the period from August 5 to November 18, 2022, and by $33/MT for the period from November 18, 2022, to March 24, 2023.

Ukrainian corn also did not withstand the pressure at the time of the second extension of the corridor.

Prior to the launch of the corridor, prices for Ukrainian corn developed mainly in a downward trend due to high stocks, a large number of offers and a very narrow export window (by rail and car across the border, by barge across the Danube and by coasters from Reni/Izmail). Then, during the first period of the corridor, corn prices at deep-sea ports increased by $5/MT due to demand from China. Also, the corn crop failure in the EU has forced importers to raise their bid prices for rail-to-border corn to compete with buyers at the corridor.

However, during the second period, corn prices in deep-sea ports decreased by $11/MT. Of course, the decline was less sizable compared to the wheat segment, as there was no such pressure from the russian origin as on the wheat market.

At the same time, demand from European buyers dried up in early November and russia began to speculate on the closure of the corridor, which meant a higher number of offers for export by rail and barge, so EU buyers lowered their bid prices. Corn prices at the ports of Reni and Ismail showed relative resilience in January-February, mainly due to the high loading of these ports at that time, as demurrage costs for corridor exports were prohibitive for some market participants and farmers held back sales during the new year holidays.

Following the second extension of the corridor, corn prices in deep-see ports continued to decline, losing another $17/MT between March 24 and May 12. russia's statement on the extension for only 60 days was one of the factors why the prolongation of the agreement did not support wheat prices in Ukraine's deep-sea ports. The 60-day period was too short to fulfil the contracts, as sometimes only a month was spent to get a vessel through the inspection to the ports of the corridor.

In May 2023, sabotage of ship inspections by the russian side and the impossibility of new ships entering the corridor forced traders to stop offering agricultural products and prices turned out to be nominal.

As soon as rumours of the corridor closure appear, multinational companies reduce their grain bid prices in Constanta, the only major alternative transshipment point for Ukrainian grain after the corridor and Reni/Izmail ports. The logic is based on a large number of offers and a narrow capacity for export. If the corridor is closed, there may be a time when seaborne sellers will have to cover demand from alternative ports. This may provide temporary support to prices for some period of time.

On May 11, it was announced that negotiations between Ukraine, Turkey, the UN and russia regarding the extension of the grain corridor in Istanbul will continue. According to various statements, there is a hint of a discussion about an extension for 60 days, taking into account the interests of russia.

We will remind you that at the time of the extension of the corridor on March 18, russia emphasized the following interests:

- reconnection of rosselhozbank to the SWIFT system;

- restoration of supplies of agricultural equipment, spare parts and service services;

- unblocking of foreign assets and accounts of companies related to the production and transportation of food and fertilizers;

- cancellation of insurance restrictions and port access bans;

- restoration of the operation of the Tolyatti-Odesa ammonia pipeline.

Some operators hoped for an accelerated decision on the eve of the presidential elections in Turkey on May 14, 2023.

In the further functioning of the agreement, the role of China cannot be ruled out, as China needs Ukrainian corn and it could be one of the forces that pushed russia to extend the agreement in March. At the same time, on May 11, a publication appeared in which it is said that russia will offer foreign partners (Turkey and Egypt) to buy russian grain on the moscow exchange. Emphasis was placed on the fact that foreign partners will be able to obtain a source of financing for a deal in rubles, either by exchanging their national currency for rubles on the foreign exchange market of the moscow exchange, or by receiving a ruble loan for the purchase of grain from a russian bank.

Exhaustion of the European demand for corn

Europe is traditionally the key market for Ukrainian corn. The only thing is that the main importers were not the neighbouring countries, but Spain, the Netherlands and Italy. In 2022/23 MY, Romania became the main importer, as a key transit zone. Spain took second place. This is followed by Poland and Hungary, which also mostly re-exported Ukrainian corn.

During the first extension of the corridor, Ukrainian corn prices held up due to the demand for corn from Europe, which faced a crop failure. According to the April USDA, corn production in the EU in 2022/23 MY fell by 18 MMT per year to 53 MMT.

However, even before the second extension of the corridor, the beginning of a decrease in corn prices was looming due to the exhaustion of European demand. And now, when the world has reached the third stage of the discussion on the grain corridor prolongation, which began on May 10-11, 2023 in Istanbul, corn prices are already showing a decline similar to the wheat segment.

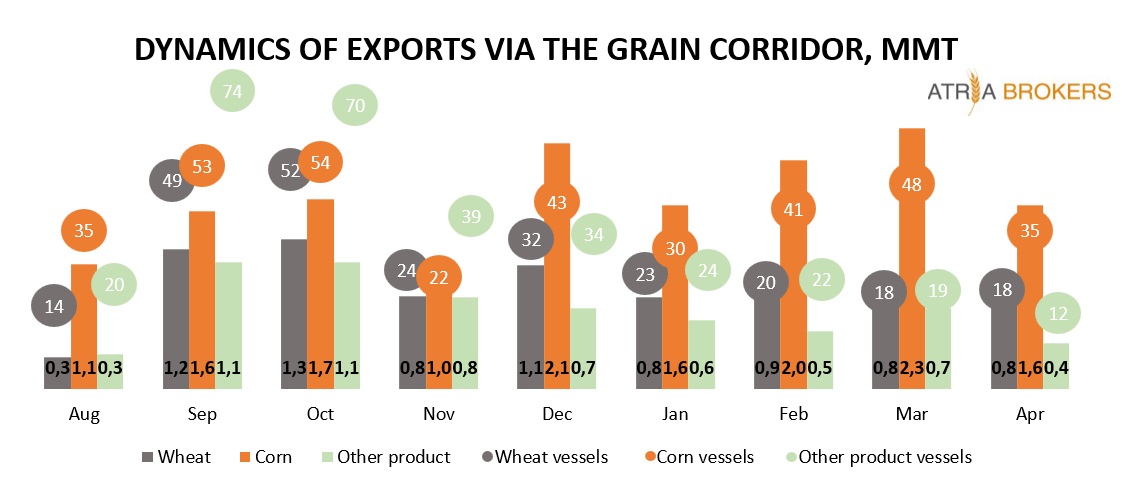

The grain corridor remains the main route for Ukrainian grain to the world market

Despite all the difficulties in the operation of the grain corridor, export through the deep-sea ports of the Black Sea remains the key route for Ukrainian grain to foreign markets, in particular to distant buyers. In July-April 2022/23 MY, Ukraine exported 14.4 MMT of wheat (18.6 MMT for the same period of 2021/22 MY), of which 7.94 MMT were shipped through the ports of Odesa, Chornomorsk and Pivdenny against 8.6 MMT a year earlier (if we add Mykolaiv, it was about 13 MMT for the same period last season). That is, three ports provided 55% of Ukrainian wheat shipments in the current season.

The export of Ukrainian corn from October to April 2022/23 MY amounted to 19.96 MMT (19.79 MMT a year earlier), of which 12.1 MMT (61%) were shipped through the ports of the grain corridor (a year earlier 13 MMT were shipped through three ports, and 16.6 MMT if we add the Mykolaiv port).

The maximum transshipment for export through the ports of the grain corridor (Pivdenny, Chornomorsk, Odesa) was in September 2022 — 3.87 MMT of agricultural products (grains, oilseeds, processed products, including vegetable oils). Corn accounted for 1.47 MMT, wheat for 1.18 MMT, and barley for 0.3 MMT.

Importance of shallow ports

In July-April 2022/23 MY, Ukraine exported 4.1 MMT of wheat from the shallow ports of Reni, Izmail, and Kilia (while there were no exports from them during the same period of 2021/22 MY). This accounted for almost 30% of shipments of Ukrainian wheat this season.

The export of corn from October to April 2022/23 MY through the specified ports amounted to 2.9 MMT (0.1 MMT a year earlier), or 15% of all Ukrainian exports.

In general, if we talk about shallow ports (Reni, Izmail, Kilia), the maximum transshipment of grain through them for the period from July 2022 to April 2023 was in March 2023 and amounted to a record volume of agricultural products — grains, oilseeds and processed products, including vegetable oils — 1.97 MMT. In particular, there were transshipped:

- 623 KMT of wheat,

- 677 KMT of corn,

- 180 KMT of soybeans.

Borders

In July-April 2022/23 MY, Ukraine exported across borders by rail and road transport:

- 3 MMT of wheat — 16% of all exports (there were only 15 KMT for the same period a year earlier),

- 74 MMT of corn — 24% of all exports (1 MMT for July-April last season).

At the same time, a record volume of agricultural products (grains, oilseeds and processed products, including vegetable oils) was delivered across the borders in November 2022 — 2.26 MMT, half of which was corn, and about 0.4 MMT was wheat.

European wheat stocks as a bearish factor and import ban by 5 countries

Due to the expectation of price growth after the end of the harvesting and the military factor, many European farmers lost the opportunity to sell at a high price, and various analysts forecast an increase in the EU's carry-over wheat stocks in 2022/23 MY by at least 1.9 MMT.

This trend was also reflected in the May USDA report – American analysts increased their forecast of carry-over stocks of EU wheat in 2022/23 MY by 4 MMT per month to the highest figure in the last 5 years – 16 MMT. A significant part of this volume is forecast in Bulgaria and Romania, if we talk about the competing countries of Ukrainian wheat in the Black Sea basin.

Instead of the price situation, a more correct explanation of why the EU banned the import of Ukrainian wheat, corn, sunflower seed and rapeseed to 5 European countries until June 5 (or longer depending on the situation) is precisely the logistical aspect and the need for free storage capacities during the initial period of harvesting campaign in Europe. This is especially relevant, knowing about the high stocks of old-crop wheat.

Wheat stocks in Australia, expectations of a high new wheat crop in the USA, EU and russia

In addition to high stocks of wheat in the EU and russia, quite high stocks are also in Australia. With Australia's record wheat crop in 2022/23 MY (39 MMT according to the USDA), the country's ending wheat stocks this season were expected at 5.6 MMT in April USDA, the highest volume in the last 10 years. But in May USDA, analysts reduced this figure to 3 MMT due to an increase in the export forecast.

Along with massive stocks, the prices are also pressured by forecasts of high world wheat production in 2023/24 MY – 790 MMT, according to May USDA. Strategie Grains forecasts an increase in 2023/24 soft wheat production in the EU by approximately 5 MMT y/y to around 130 MMT. Thanks to spring rainfall, operators' expectations for the US wheat harvest have improved. As for russia, local analysts continue to increase the forecast for the 2023 wheat harvest due to favourable weather conditions. Currently, the forecast varies at the level of 83-86.8 MMT, which could become the second or fourth record for the country after 92-104 MMT in 2022. The May USDA was more sceptical about the russian wheat production forecast – 81.5 MMT.

Thanks to spring rains, the April IGC forecast the US wheat crop in 2023 to increase by about 5 MMT y/y to 50 MMT, but the May USDA decided to leave the 2023/24 forecast at the previous year's level of about 45 MMT.

Demand from Turkey to be restrained until September

It is no secret that during the wheat harvesting campaign in Turkey, the country traditionally tries to protect domestic producers. In the 2023/24 season, Turkey is returning to the trade structure that existed in 2018, when flour millers first had to fulfil a flour export contract and only then they could obtain licenses for duty-free wheat imports.

For companies without licenses, the import duty on wheat is 130%, which makes it completely impossible for such operators to import. Therefore, in the first place, flour mills will purchase wheat on the domestic market, while a more or less intensification of imports is expected only in September 2023. The wheat production in Turkey in the new season is expected to be at the highest level in the last 5 years – 19 MMT (+1.75 MMT y/y).

Financing problems in Europe

A separate problem in the current season was the delay in payments from importers of Ukrainian grain by rail and road transport. This was primarily due to the fact that the final buyers in the contracts with the intermediaries to whom the Ukrainian goods were sold, stipulated payment within two to four weeks or more. Very often, final buyers delayed payment for an even longer period, which also affected payment under Ukrainian export contracts.

A new incentive for European farmers to hold stocks

On the eve of the new season, farmers in Bulgaria and Romania found a new reason to sit on the stocks. The quality of Romanian and Bulgarian grain in 2022/23 MY is quite good – the protein is often higher than 13%, and the grain weight is close to 78 kg/hl. Not knowing how the current rainfall in Europe will affect the quality of the new wheat crop, farmers very often decide to keep this quality. At the same time, Ukraine and russia continue to sell wheat looking at the world situation.

Summarizing the above, we see that the current prospects for grain exports from Ukraine look very tense. If russia blocks the continuation of the grain agreement or continues to inhibit the passage of ships through the corridor, Ukraine will have two export routes – through the western borders and through the river ports on the Danube. The capacity of both ways is limited. So far, the record monthly export of agricultural products (grains, oilseeds, and processed products) through the ports of Reni, Izmail and Kilia amounted to 1.97 MMT. At the same time, the record monthly volume of agricultural products (grains, oilseeds, and processed products) was delivered across borders in November 2022 – 2.26 MMT. In theory, if Ukraine were to set such a record every month, then in 12 months the export of the specified agricultural products could amount to 50.8 MMT.

Of course, such a calculation of the capacity of borders and shallow ports is not compatible with reality. In addition to the logistical factor of availability of wagons and freight rates, demand and supply play an even more important role. Most Ukrainian commodity positions are competitive in price only when exported through deep-sea ports, for example, sunflower oil to India and China, and Ukrainian corn and sunflower meal to China.

In the May report, the USDA forecasts the export of grains, oilseeds and processed products at 44.5 MMT in 2023/24 MY, but if the UGA forecast is implemented, then exports can amount to about 53 MMT.

Christina Serebryakova, broker and analyst of Atria Brokers

Artem Rozhkov, broker and co-founder of Atria Brokers