Bitcoin vs. Corn. Agroholdings Make Their Stand

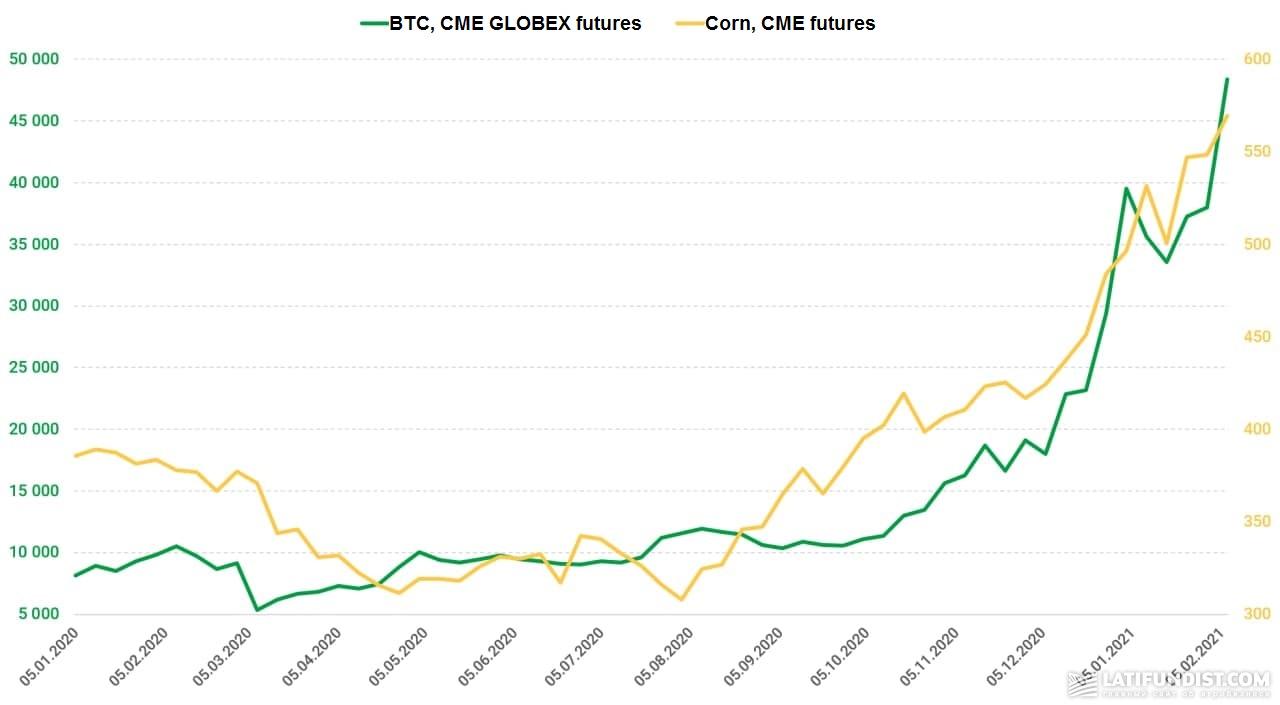

In the year 2020, financial and commodity markets lived major drama stretching from an all-out drop at the start of the year to an incredible bullish rally that continued through six months.

Although corn and bitcoin are fundamentally different asset types, the futures dynamics are very similar as they show well the common trends in commodity and financial markets last year. First, there was a collapse in February and March amid the unfolding of the coronacrisis and the global lockdown, which caused a downturn in the global economy. In summer, markets settled down, the prices reach a plateau. At that time, quarantine restrictions were eased in most of the world due to a decrease in COVID-19 spread dynamics. The world economy started recovering from the fall in Q1 and Q2. And then something what most analysts had warned about happened: in August there was a sharp rise out of the consolidation zone and corn futures renewed their five-year highs ahead of the new year, while bitcoin reached its all-time high.

The superabundance of liquidity in the economy and the financial market injected by the Federal Reserve System (FRS) and the European Central Bank (ECB) with the aim of tackling the aftermath of the crisis was the main driver of this process.

Let's explain to evince the scale: since March 2020, the seven leading central banks issued the equivalent of USD 9.4 tn in additional financial resources. Ergo, it was only a matter of time before an inflationary explosion occurred.

With the dollar depreciating due to excessive emissions and deliberate devaluation by the US government to stimulate exports, investors started searching for alternative assets to invest in. It was the entry of large institutional investors into the market that fuelled the tremendous bitcoin rally.

Some of the most publicized purchases of cryptocurrencies by major players include hedge fund Tudor Investment's USD 50 mln purchase of bitcoins in May, analytical giant MicroStrategy's USD 425 mln purchase of 38,200 BTC in August, and, of course, Elon Musk, who is driving markets to new highs with his Twitter posts. First, he boosted the value of DogeCoin by more than 50% with his tweet, and on February 8, 2021, it was reported that Tesla bought USD 1.5 bln worth of bitcoins, prompting the cryptocurrency to go up nearly USD 10,000 in just a few hours.

Corn slalom

Corn, however, has a different market history, but the outcome is largely similar. Grain futures on the CME held lows until early August 2020. Corn prices suffered a double blow in the first half of the year. First, the lockdown, which caused a fall in demand and complicated logistics because of quarantine measures at the ports, then the forecasts of record gross yields from the USDA. But expectations of record harvests in the key Northern Hemisphere production regions did not show up, so the USDA started to gradually cut both the global production forecast and the stocks. This was accompanied by China's robust import activity, which has significantly increased its corn purchases compared to previous seasons.

These factors dramatically warmed up the market, creating a strong bullish trend which attracted the attention of funds pushing them to actively buy agro commodities futures on the CME.

But at some point, the overpriced assets return to their objective values, the market bubbles burst. Most traders and observers believe there are several of these bubbles in the financial markets now, and QE programmes from central banks further inflated them in the past year. Among the most overvalued assets are cryptocurrencies, as well as shares of US technology companies, with the prospect of bursting estimated at a maximum of 1 year. A collapse in financial markets on the back of the fall of the aforementioned assets could trigger a global financial crisis (similar to what we saw in 2008-09), and the recovery of the global economy after the coronacrisis will be W-shaped rather than V-shaped, as currently forecasted.

What will happen to corn? It will be fine. Sure, there will be changes in the new bullish super-trend that started last year in the backdrop of the crisis. But they will only be corrections followed by further price increases. There are fundamental factors upholding agricultural commodities now and it is impossible to drive them out of the equation. These are the good old supply and demand factors that are influenced by the constant growth of world consumption and, on the other hand, changing environmental conditions affecting the productivity of agriculture, Zernotorg.ua analyst Oleksandr Tyshchenko observes.

Latifundist.com asked Ukrainian agricultural holdings whether they see potential in investing in bitcoins, or corn will exert further its hold over the market and the minds of traders.

Oleksandr Illin, CFO UKRAVIT, does not confide in bitcoin as a global digital currency and is not ready to support such risky investments.

Oleksandr Illin, CFO UKRAVIT

From my personal standpoint, bitcoin is a bubble. What is the value of any commodity, corn or gold for example? It is in the balance of supply and demand, which in turn is shaped by the demand for further processing chain or direct consumption. And what is the value of bitcoin? What is it backed by? Merely by direct demand. And the demand for bitcoin is pure marketing. We've already seen several downturns in demand for bitcoin to scant interest. Demand has gone down, bitcoin has gone down.

Furthermore, Oleksandr Illin says, bitcoin is rather low-tech in terms of the possibilities of using blockchain technology itself (Smart contracts, etc.).

Oleksandr Illin, CFO UKRAVIT

Suppose Elon Musk accepts bitcoins as payment for Tesla. OK. How much? For example, one BTC would be secured by a guaranteed delivery of one Tesla. That's when the value emerges. And it won't be a floating rate. We make it perfectly clear that one Tesla = one BTC. But still this offer is limited by the risks posed to Tesla itself, as the question arises whether Tesla's commodity suppliers will continue to accept bitcoins as payment for their products and at what value, especially if it depreciates. Musk's latest deal, a USD 1.5 bln bitcoin purchase, is a free capital investment that the company does not need to maintain operational liquidity. Such a company could afford to risk 1-1.5% of capital by investing it in a speculative instrument, realizing that such a move would only spur demand in the short term.

Roman Horokhovskykh, director of international projects at TAS Agro, falls in with his colleagues and argues that investing in bitcoins is a separate speculative area, which currently has no direct connection to agricultural production.

Besides, if one regards the last year's results, corn yielded quite good results. TAS Agro plans to continue working in an area in which it is well versed, that is, agricultural production.

Roman Horokhovskykh, head of international projects, TAS Agro

When it comes to investing heavily in a new business, it is important to be able to control or at least have a weighty impact on the outcome. Many people may have already made money from bitcoins. However, no one knows when or how this story will end. Therefore, we are most likely to continue investing free funds in assets that will enable us to improve agricultural production.

As for Ukrainian-American developer Mark Ginzburg, he is convinced that bitcoins are the future. And though they won't oust banks and fiat money(Fiat money is a government-issued currency that isn't backed by a commodity such as gold.), they will reduce their number and change the algorithm of their work.

Mark Ginzburg,

Blockchain ideologist

The dominance of fiat money has come to an end. Bitcoin is the future. Will bitcoin survive? We can say that it will, given the fact that its emission is 21 mln and there are 17 mln mined so far. The less of it remains, the more complicated is the algorithm of calculations and more expensive the necessary energy resources, so the price will grow up to USD 40 thou. and more... Bitcoin is highly volatile, which is determined by a whole set of subjective factors. But I believe in bitcoin's growth and I am confident that it will go as high as USD 40 thou. (bitcoin passed the USD 48 thou. mark on 9 February 2021 – ed.). I also believe in bitcoin as an asset. But I am strongly against it being seen as a speculative asset and investing last bit of one's money in it.

He also added that the time will soon come when cryptocurrency owners will have to declare their cryptocurrency wallets. The IMF and the tax authorities of the world's leading countries have already started setting up their own cryptosystems.

By the way, Mark Ginzburg became famous in the tech world for selling a flat via smart contracts on the Ethereum blockchain. The billionaire and co-founder of TechCrunch, Michael Arrington, bought a flat in Kyiv for USD 60,000.

Konstantin Tkachenko, Natalia Rodak, Latifundist.com