Corn Market in 2019

Corn is the world's most popular grain crop. It is consumed by people, it is used both in animal feed and fuel production. Let's analyze how much corn was sown in 2019, what crop was harvested, how the areas under this grain crop in Ukraine have changed and other no less important factors.

1. Five major producers account for more than half of all areas under the crop

Of the world's 1,870 mln ha sown in 2019, 191.5 mln ha or 10%, were allocated to corn. According to Kleffmann Group, the five world leaders in corn cultivation cover 110 mln ha, including:

- China: 41 mln ha

- US: 33.1 mln ha

- Brazil: 18.1 mln ha

- India: 9.5 mln ha

- EU: 8.6 mln ha

Ukraine ranks ninth in this list with an area of 4.9 mln ha or about 3%.

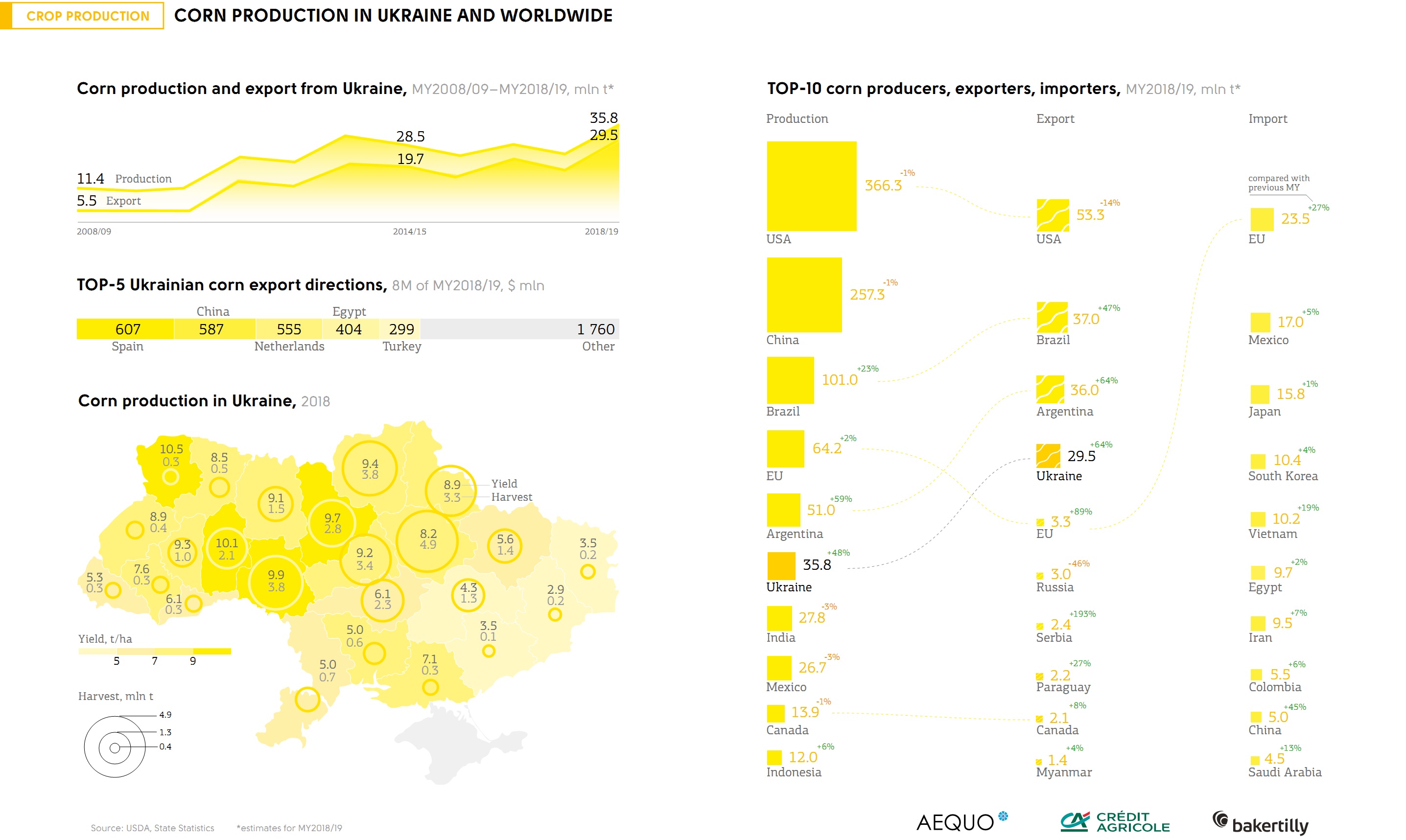

2. Global corn production

The global production of corn amounted to 1,102 mln t in 2019. The US and China hold the leading positions in production: the US harvested 347 mln t due to high yields and China produced 254 mln t due to vast areas. Ukraine ranks sixth with 36 mln t or 3% of total world production. With the smallest area under the crop, Turkey is the leader in terms of yields – 11.5 t/ha. The US and Canada have almost the same result: 10.5 t/ha and 10.0 t/ha, respectively.

3. One-fifth of sown areas in Ukraine is covered by corn

The share of corn for grain among all crops is almost 18%, while a year earlier it accounted for 16.5% with a total arable land area of 27.3 mln ha. According to ProAgro experts' estimates, in 2020 5.1 mln ha will be under corn for grain, which is a record figure.

4. In 20 years, the area under corn has increased almost fourfold

In 2019, 5.005 mln ha were sown with corn, of which 4.987 mln ha or 99.6% were harvested. Last year, producers planted this crop by almost 425 thou. ha more, which amounted to 108.5% compared to 2018, whereas the harvesting area was only 75% of the planned. Since 2000, this area has increased by 290%, from 1.278 to 4.987 mln ha.

5. Regional change of cultivated areas in Ukraine

Significant changes have taken place in the regional distribution of areas under crops and in the structure of production. In 2000, the entire area of corn harvest in the Forest Steppe regions was inferior to that in the Steppe and it was very low in the Polissya. Almost in 20 years, there were significant changes by 2019 as a result of natural and climatic conditions variation and as a response to the development of cultivation technology of this crop. Last season, the harvested area of corn in farms of the Forest Steppe regions amounted to 2.858 mln ha and already exceeded similar indicators in the Steppe (1.158 mln ha) more than twice. The Polissya agrarians expanded the area to 971 thou. ha as compared to 83 thou. ha in 2000.

TOP 5 regions by corn harvesting area (thou. ha):

- Poltava: 662

- Chernihiv: 494

- Cherkasy: 413

- Vinnytsya: 412

- Sumy: 407

6. Yields increased by 1.5x over 10 years

Most importantly, there has been a significant increase in the average yield of corn. In 2010, this indicator stood at 4.51 t/ha and grew 1.5x over 10 years to 7.19 t/ha. However, it remains 31% below the average yield in the US.

TOP 5 regions by yield (t/ha):

- Khmelnytsky: 9.41

- Volyn: 9.33

- Ternopil: 9.19

- Vinnytsya: 8.67

- Zhytomyr: 8.41

The Polissya and Forest Steppe agrarians achieved the highest increase in the average yield of corn for grain. In particular, in the regions of Polissya the average annual yields of corn for grain in farms of all categories improved to 7.78 t/ha, in the Forest Steppe to 7.77 t/ha, while in the Steppe to 5.18 t/ha.

7. Corn comprised almost half of the bumper crop of 2019

In 2019, Ukrainian agrarians harvested 35.8 mln t of corn, which is almost 1.5x (or 57%) more than in 2011. Last year, the gross yield of corn in the regions of the Forest Steppe (22.026 mln t) exceeded the total result of the Polissya and the Steppe (7.724 and 6.130 mln t, respectively) by 1.5x. At the same time, corn accounted for almost half of the record harvest of last year. Thus, Ukraine ranks 6th among global producers following the US, China, Brazil, EU countries and Argentina.

TOP 5 regions by corn gross yield (mln t):

- Poltava: 4.618

- Chernihiv: 3.928

- Vinnytsya: 3.575

- Sumy: 3.245

- Cherkasy: 3.191

The increase in gross corn yield was made possible by a 38% rise in average yields and a 400 thou. ha additional area.

8. Corn exports have doubled in five years

In the March USDA report, the export forecast for Ukraine in 2019/20 was set at 32 mln t. This indicator has almost doubled from 16.595 mln t in 2015/16. In addition, the current season's corn export rate is forecast to grow and increase by 1 mln t YoY.

9. Ukraine exports 50% of corn to the EU countries

In the 2018/19 season, Ukraine exported more than half of the total volume of corn to the EU – 16.05 mln t. Countries in Africa, the Middle East and Asia import Ukrainian corn in almost equal shares. Over the last five years, China (from 0.5 to 3.82 mln t), Turkey (almost from nothing to 2.42 mln t) and the Netherlands (+2.39 mln t) have shown significant growth in export volumes. At the same time, there are countries that have reduced imports from Ukraine: Japan (-98%), South Korea (-81%) and Iran (-49%).

TOP 5 markets for Ukrainian corn in 2018/19:

- Spain: 4.27 mln t

- Netherlands: 4.13 mln t

- China: 3.82 mln t

- Egypt: 3.05 mln t

- Turkey: 2.42 mln t

Import of corn to Ukraine in 2018/19 was insignificant – 35.3 thou. t.

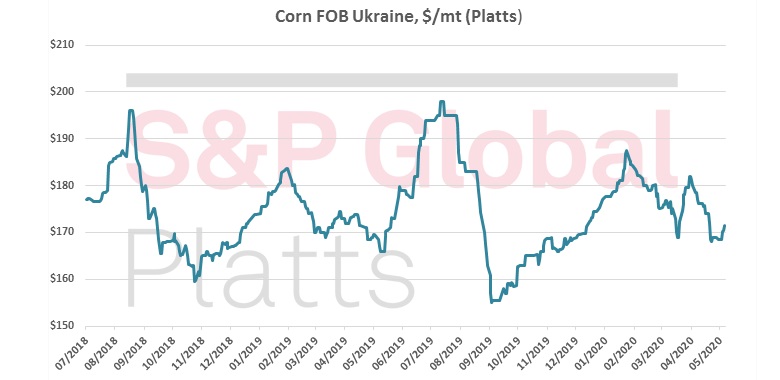

10. Average prices of corn sold

Pursuant to the State Statistics Service, the average corn price in Ukraine within 2011 and 2019 has increased by more than 2.5x (or 170%) to 3,684.6 UAH/t. Although, over the past year, there has been a decline in prices by 326.9 UAH/t or 8%.

|

2011 |

2012 |

2013 |

2014 |

2015 |

2016 |

2017 |

2018 |

2019 |

|

1366,3 |

1515,2 |

1210,6 |

1744,7 |

2989,9 |

3530,0 |

3668,9 |

4011,5 |

3684,6 |

Volodymyr Demchuk, Latifundist.com analyst