How Germans Introduced Ukraine to Rapeseed. An Interview with Michael Rjasanowski

German by birth, Michael Rjasanowski came to Ukraine for the second time. In the early 1990s, he worked in a Ukrainian office of Bayer. Since 2017 Michael is the director of NPZ Ukraine, more commonly known in the country as Lembke. In the early 90s, the company specialized in rapeseed and, in fact, forged the tradition of its cultivation in Ukraine. Today, NPZ Ukraine offers a wide range of seeds and will soon commission its own seed plant in Zhytomyr region. Latifundist.com interviewed Michael Rjasanowski about the rapeseed market and the fine points of its cultivation.

Latifundist.com: The company was known as Lembke for a long time, then the name was changed to NPZ. Why was it renamed?

Michael Rjasanowski: The company has never had its name changed. NPZ was founded in 1897, but after the war, the German Democratic Republic (GDR) took it over and made it state-owned. And the owner, Mr. Lembke, kept his position as director there. His son moved to West Germany and set up a company under the same name on the Baltic Sea.

When Germany was reunited in 1992, the company in the west bought out the one in the east. And the name NPZ (Norddeutsche Pflanzenzucht Hans-Georg Lembke KG) was preserved for the merged company. Indeed, in Ukraine, it is probably more remembered simply as Lembke (by the name of the owners). Here, the company operates as NPZ Ukraine.

Latifundist.com: Is it fair to say that the rapeseed production tradition started in Ukraine with NPZ?

Michael Rjasanowski: Sure it is. I must admit that, both in the Soviet Union and in the first years of independence, rapeseed was not popular in Ukraine. This oilseed crop was grown largely as feed for cattle, a component of the green conveyor since grain crops yielded low. Thus, the area under rapeseed varied from 8,000 to 40,000 ha.

We know that in those days varieties, not hybrids, were cultivated. And the problem with rapeseed was that its grain could in no way be used for human nutrition or as a component of animal feed, but only for industrial oil production. In the mid-1980s, German breeders developed the double zero '00' variety of rapeseed with a low content of erucic acid and glucosinolate. This rapeseed was fit for human and animal consumption.

In the early 1990s, my colleagues from NPZ came to Ukraine, they saw that rapeseed (the one for industrial purposes) was grown there, especially in the western part of the country, and they realized that new varieties of the crop could be offered to producers. There were three strong reasons for this. Firstly, the new varieties yielded higher yields. Secondly, the '00 rapeseed' was usable as livestock feed. Thirdly, this rapeseed could be exported.

Another significant thing was that at that time private inputs distribution companies started to appear in Ukraine and agrochemicals became available. In other words, the crop could be grown professionally since the proper protection products, markets, etc. were accessible.

Latifundist.com: Essentially, the company was introducing crop production technology.

Michael Rjasanowski: The new high-yielding rapeseed required a completely different approach compared to its predecessor, and the technology developed in Germany had to be adapted to Ukrainian conditions. The timing and depth of seeding had to be communicated to farmers, as well as when and what kind of crop protection products had to be applied. Previously, large seeding rates were common, the crops were too dense, the plants took moisture and nutrients from one another. The task was to reduce the seeding rate, to see what factors generally affect the yield of this crop. That is, rapeseed cultivation needed adjustments in all respects starting with the choice of variety, seeding rate, fertilizer application, moisture analysis, use of protection products, etc.

Latifundist.com: How did farmers respond?

Michael Rjasanowski: At first, they were very skeptical, unprepared to invest more money in the crop. But the first results and the opportunity to export rapeseed gave an impetus to the development of this crop in Ukraine.

Latifundist.com: What is the NPZ rapeseed business in Ukraine today?

Michael Rjasanowski: The company has two subsidiaries in Ukraine. NPZ Ukraine specializes in the local development of the crop: this includes adaptation to the Ukrainian market and the selection of high-yielding hybrids. The company registers hybrids and sells them. NPZ Service is our new seed processing and packaging plant.

Latifundist.com: Does the company sell seed directly to farmers or via distributors?

Michael Rjasanowski: I believe that everyone should do their job. Distributors are professionals in sales. We are professionals in breeding, cultivation and production. We cooperate with three distribution companies.

As far as the big international seed and agrochemical suppliers are concerned, such processes are cyclic with them: first, decentralization of processes is their thing, then centralization. The same is with direct sales...

Related: STRAIGHT TALK WITH A DISTRIBUTOR. Seed and Chemicals Producers Switched to Competing With Distributors

Latifundist.com: Will you add more trading partners?

Michael Rjasanowski: We have not planned it yet. But the market is dynamic, so I wouldn't rule it out.

On the portfolio and seed market

Latifundist.com: What other crops besides rapeseed does the company have in its portfolio?

Michael Rjasanowski: We offer spring and winter rapeseed of NPZ selection. We also sell seeds (both varieties and hybrids) of our sister company SAATEN UNION (NPZ is one of the founders of this company). These include wheat, rye, barley, oats, corn, sunflowers and pulses.

Latifundist.com: When and why did you start to expand the company's product range?

Michael Rjasanowski: 3 or 4 years ago we started to increase the portfolio following customer demand. So far rapeseed dominates sales. But the share of other seeds is growing every year. After all, a farmer cannot grow a single crop. In fact, I think it is a wrong approach for the market to focus on five crops, there should be diversity. For example, our specialists see great yield potential in hybrid rye. Why not make use of it?

Of the 30 mln ha of arable land in Ukraine, rapeseed covers only 1 mln ha. The market potential is enormous. The company already has more than 1,000 customers in the country. There is a team and a new factory. So, we will continue to develop.

Latifundist.com: You have mentioned the low rapeseed yields in Ukraine in the 1990s. What was it then and what is it now?

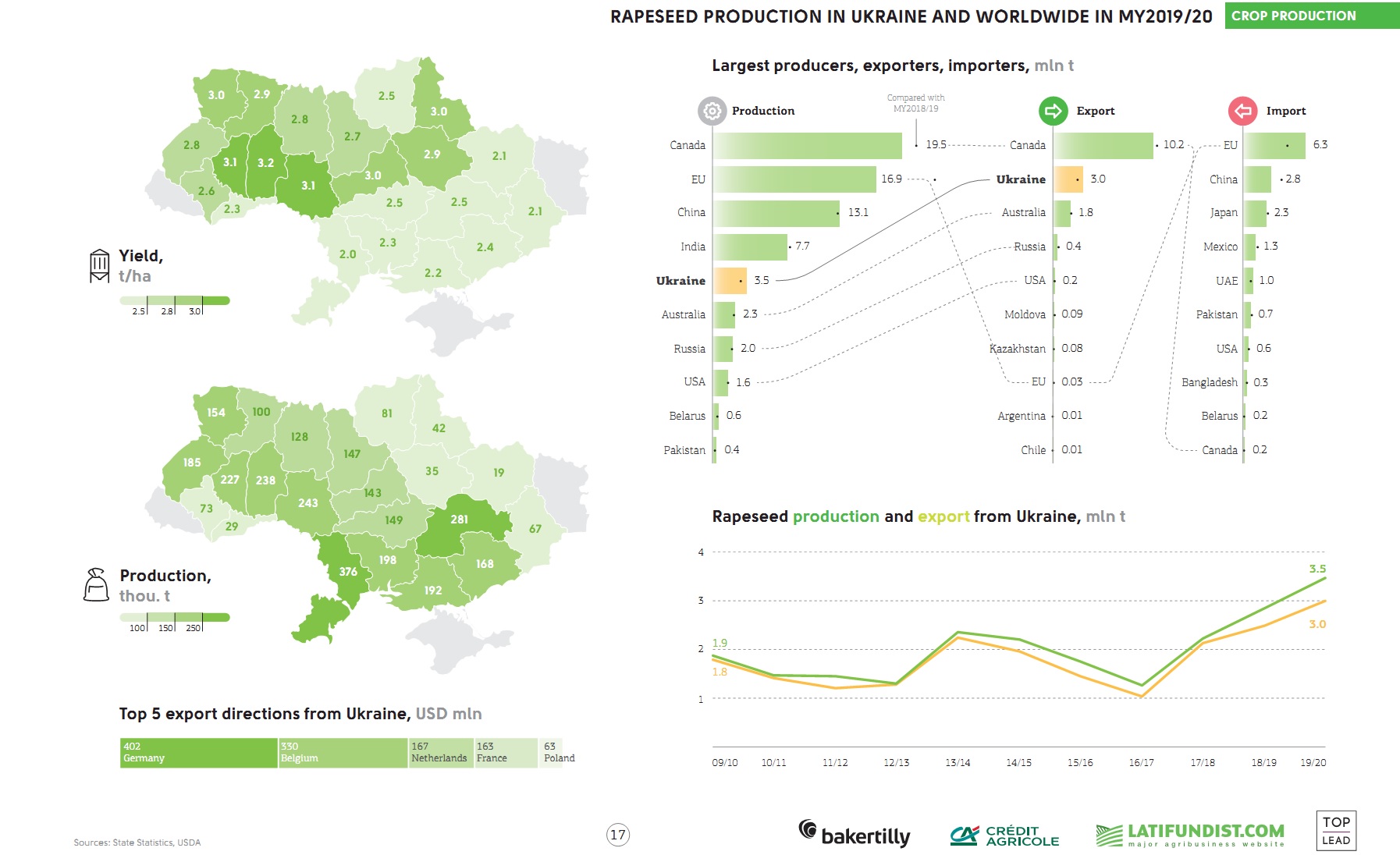

Michael Rjasanowski: Until 2007, the average rapeseed yield was 1.3 t/ha. In some years, it was below 1 t/ha. Now the average yield in Ukraine is 2.5 t/ha, while in Germany it is a quarter higher. NPZ has been introducing rapeseed hybrids into the markets since 2002. They require a high cultivation technology. It took time for the farmers to improve the technology and get used to the crop. I remember in 2005 in Germany, 50% of the rapeseed market were hybrids. In Ukraine, of course, this figure was even lower. Today, hybrids already account for around 80% of the segment.

But since 2007, the demand for rapeseed has been climbing as the price of rapeseed on the world market has risen. In my opinion, it was then that Europe started to scale up biodiesel production. Rapeseed production in Ukraine stood at 600 thou. t, but in 2008-2009 it grew up to 3 mln t. Since then, 2,5-3 mln t of rapeseed is harvested in the country annually. So today it is a promising crop in the crop rotation system.

Latifundist.com: How would you estimate the company's share of the Ukrainian seed market?

Michael Rjasanowski: We can refer to the rapeseed segment, or even more specifically, the niche of rapeseed hybrids. For a long time, every second field of rapeseed was of NPZ selection. In recent years, with the development of the segment, our share has stabilized at 25%. Increased competition is a healthy process.

Latifundist.com: And how has the number of players in this segment increased?

Michael Rjasanowski: If 10 years ago there were 7-8 foreign breeding companies, today there are surely more than 15.

Latifundist.com: What in your view are the prospects for rapeseed production in Ukraine?

Michael Rjasanowski: Rapeseed in Ukraine is an established crop that is in consistently high external demand. In terms of crop rotation, the potential area under rapeseed is up to 6 mln ha. I see the potential of rapeseed production on 1.5 mln ha. In that case, it is a sustainable business. Moreover, with rapeseed, it's critical to observe a balanced crop rotation. After all, to keep the plants healthy, they should not be sown in the same field more than once every four years. Unfortunately, farmers often neglect this rule.

Latifundist.com: You mean in Ukraine.

Michael Rjasanowski: No, not only in Ukraine. In Germany too. German farmers differ from Ukrainian farmers in that they own the land, they want to preserve it for their sons. But agrarians in both countries do not always realize that the problem does not just appear, but builds up from year to year and reaches its peak at one moment. Hence it is fundamental to follow crop rotation principles when growing rapeseed.

Latifundist.com: What other factors will shape the development of the rapeseed market?

Michael Rjasanowski: One should keep in mind that rapeseed areas and yields have been decreasing in the EU in recent years, not only in the face of climate change but also due to pesticide and fertilizer application restrictions. Yet the EU still produces 16 mln t of rapeseed each year out of the required 20-21 mln t. This shortage of 4-5 mln t can be covered with 1,5 of rapeseed produced in Ukraine.

Rapeseed cultivation is largely shifting eastwards: to Poland, Romania, Hungary, Ukraine and Belarus. Unfortunately, some companies register rapeseed hybrids in Ukraine that are successfully grown in Western Europe. But this carries serious risks since conditions here are different, and it's essential to carefully select and adapt hybrids. You can trust me on this for the company has extensive experience and solid expertise in verifying the effective use of hybrids. Our company probably has the most extensive rapeseed breeding program.

It happens so that some hybrids do give a good result, but no one can guarantee that they will yield no less next season.

On the seed plant

Latifundist.com: When and why was the company determined to invest in a seed plant?

Michael Rjasanowski: It was not an unexpected decision. It was a logical decision for a company that has been operating on the Ukrainian market for many years. The aim was to decentralize seed production, to be closer to the customer. Having your own production facility makes it possible to respond more quickly to specific customer needs. And in the EU there are many restrictions on the use of crop protection products, etc., and having our own plant in Ukraine means we can be more adaptable and flexible.

Latifundist.com: What is the enterprise's capacity?

Michael Rjasanowski: The plant produces 100-150 t of seed per day. But it is not the capacity of the plant that is more important, but the ability to give customers exactly what they want. For example, we now have 19 rapeseed hybrids in our portfolio. Customers order different seeds, packaging (paper bags or big bags). Some want seeds to be pesticide-treated, others prefer untreated ones, etc. In other words, own production is an opportunity to fulfill any order promptly. Therefore, it is not so much the productivity of the plant that is important to us, but rather the ability to be versatile. Although, we built the plant having the potential to expand its capacity in the future.

Latifundist.com: Will the company treat exclusively its own seeds or provide services to third parties too?

Michael Rjasanowski: Originally, we considered only our own seeds. But such a high-capacity enterprise should not be idle, so we will also render seed treatment and packaging services.

Latifundist.com: There are concerns that seeds of European selection grown in Ukraine are worse than those grown in the EU. What is your stand on such judgements?

Michael Rjasanowski: When passing a judgement about seeds produced in Ukraine, one should consider how long they have been produced. If the production cycle is only 1-2 years, that is not enough. A standard has to be set and adhered to. At the same time, the Ukrainian NPZ plant now has more modern equipment than our facilities in Europe. Therefore, these seeds will definitely not be worse than those by our European colleagues.

Latifundist.com: Does the company refine only European-grown seeds at the Ukrainian plant?

Michael Rjasanowski: Yes, it doesn't make sense for us to grow rapeseed here. The crop has a very high seed propagation capacity. For example, one hectare of rapeseed may yield seed for 16-200 ha. By comparison, on one hectare of peas (depending on the region of cultivation) seed for 8-13 ha may be harvested. This is why we grow rapeseed in Germany.

Although, when it comes to other crops, we bring elite and super elite seeds to Ukraine, and we grow and sell them here. We collaborate with 35 farms.

On the global and Ukrainian rapeseed markets

Latifundist.com: What trends in the global rapeseed market would you mark and how do they determine the Ukrainian market?

Michael Rjasanowski: Although there are many crops in the oilseed segment, changes in rapeseed prices are always dependent on fluctuations in soybean prices. When a good soybean crop is expected, rapeseed prices go down. If, for example, there is news that Asian soybean rust is detected in Brazil, rapeseed wins.

Around 70 mln t of rapeseed is produced worldwide, far less than other oilseeds such as soybeans. Canada is the largest producer of rapeseed, growing mainly genetically engineered spring rapeseed. The EU, China, India and Australia are the biggest producers following Canada. Then we have Ukraine, Russia and Belarus. It's important for Ukrainian producers to monitor changes occurring in the European market. There, as I have said, is a lack of 4-5 mln t of rapeseed a year. Despite China is a large producer, it also imports rapeseed. I've heard that Ukraine supplied rapeseed to Canada. It is hard to believe, but anything is possible.

Latifundist.com: What are rapeseed prices on the world market?

Michael Rjasanowski: The price is now at an absolute peak, above 500 USD/t. In recent years it fluctuated between 300 and 350 EUR/t.

It is clear that price volatility can be speculative, it is not always a benchmark for production. A more important consideration is demand on neighbouring markets.

Latifundist.com: But you have stated that rapeseed production in Ukraine has remained stable over the years. . . So is there no demand in Europe to boost production?

Michael Rjasanowski: Climate is a significant deterrent. Rapeseed sowing normally starts on 20 August. But if it is hot and there is no moisture, many do not sow or sow in dry soil and then lose it. That is why the area under rapeseed is not increasing.

We now recommend sowing rapeseed as early as the end of July. But in this case, the plants' development should be properly regulated. The second challenge for rapeseed is winter. Although rapeseed of our selection can withstand frosts of down to 20-22°C, it will not survive without snow. Icy crust, heatwaves during flowering are dangerous for the crop. This year, in France there were cases when rapeseed froze during flowering. In other words, the crop cannot be called undemanding.

Latifundist.com: Yet many companies continue growing rapeseed once they have tried it.

Michael Rjasanowski: For farmers in western, northern and central Ukraine, rapeseed is a traditional, standard crop. In the south of the country, rapeseed cultivation is rather risky. It is difficult to get seedlings there, but if there are any, the plant will tolerate drought better than spring crops. When sunflowers are sown in Ukraine, rapeseed roots are already over a meter long and can survive very dry conditions. In Europe, this fact is not paid much attention to, but in Ukraine it is essential.

Learn more: TOP 10 Rapeseed Producing Countries in 2019

Latifundist.com: Have the so-called "soybean-rapeseed amendments" had any impact on rapeseed production in Ukraine?

Michael Rjasanowski: No, they haven't.

Latifundist.com: Is there genetically engineered rapeseed in Ukraine?

Michael Rjasanowski: Actually it is forbidden, but it is said that someone brought in GE rapeseed from relatives in Canada and tried to grow it... This is, of course, awful. Such things should be strictly controlled at the border. After all, this is how Ukraine has already ruined the soybean market for itself. But the fields are cleaned faster after soybean than after rapeseed. Rapeseed remains in the soil for 20 years.

Latifundist.com: It's been an interesting conversation about rapeseed. We wish the company success in other segments of the Ukrainian seed market as well.

Alla Sylyvonchyk, Latifundist.com