Corn export prices hit five-year maximum: Refinitiv

Earlier this week, export quotations for Ukrainian corn rose to the highest level since 2016 (since Refinitiv started monitoring the Black Sea region grain market), the company reports.

A rise in corn benchmarks on world markets to an eight-year high following unfavourable weather conditions in the Western Hemisphere and fears of supply shortages contributed to a strengthening of Ukrainian corn prices.

"May/June corn offers from Ukraine reached 288-290 USD/t FOB and 270-275 USD/t CPT. The rapid movement in futures curbed the number of sellers in the market, who preferred not to take risks and wanted to wait for prices to stabilise," the message reads.

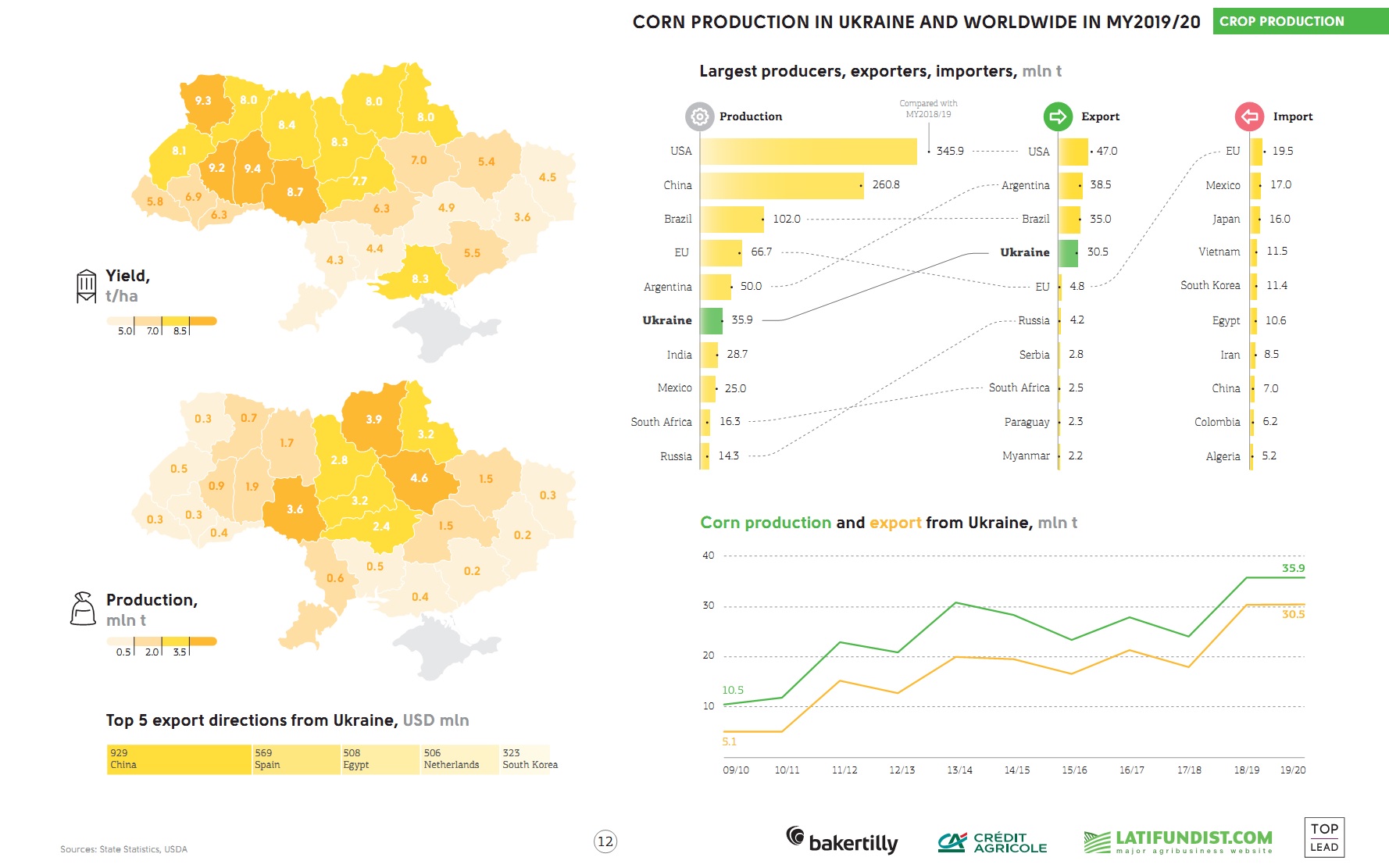

Analysts noted that external demand for Ukrainian corn has slightly intensified, with the market seeing interest from its closest importers and the domestic market getting demand to cover previously signed contracts for supplies to China, Iran and South Korea. Exporters note that amid weakening export potential for wheat, corn trade remains highly liquid.

Supply prices for Ukrainian new crop corn also strengthened last week, gaining 15-18 USD/t and are at 238-240 USD/t for October-November loading period.

"After adjustments on world markets, export prices for Ukrainian corn have declined slightly, but the market remains uncertain about demand prospects and strong competition with grain from the US and Argentina," analysts explain.

UGA expects corn export from Ukraine in the 2020/21 season no higher than 22 mln t.