Ukrainian grain continues its price gain — ASAP Agri

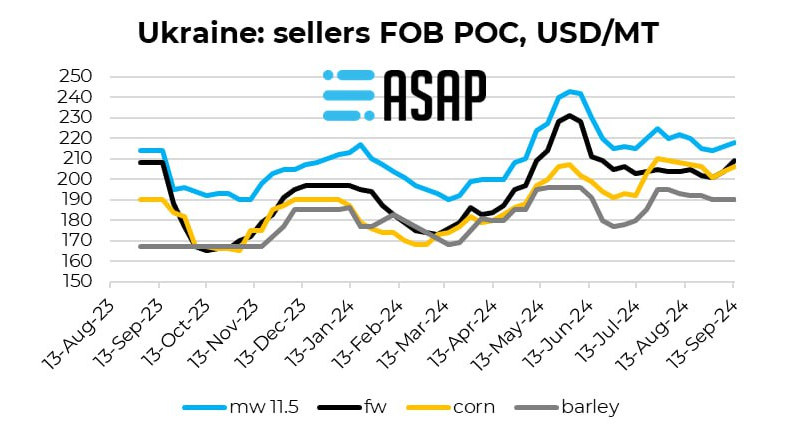

Corn is seen as the driver of this positive momentum. Indeed, some market operators since the beginning of the week have increased their buying ideas for corn by at least 2-3 USD vs. Friday levels to about 188 USD/MT on a CPT POC basis, ASAP Agri analysts say.

"Even better levels were possible to get for spot September and November-December delivery periods. How much above — depends on the volume and period of delivery. Global consideration with a December contract on CBOT now well displayed over the 4$/bu threshold supports the physical market. At the regional level, availabilities amongst direct competitors of Ukraine on the export arena have been revised down at the occasion of the latest USDA release. It concerns russia, Serbia, but also Romania and Bulgaria."

The milling wheat is keeping its +10 USD premium vs corn, on a spot basis. It suggests that CPT deals for wheat are recorded in the neighbourhood of 200 USD/MT. Farmers will be reluctant to sell their milling wheat below this price, especially as oilseeds continue to demonstrate their strength against the grains.

There is a chance that producers would better sell rapeseed, soybeans or sunseed and continue to keep milling wheat in the warehouse, expecting better prices.

"All farmers deed in mind have nostalgia for end-May trades on CPT for 12.5% protein wheat at 220 USD/MT. Feed wheat prices are evolving in the wake of corn ones, demonstrating a quasi-parity. Barley profits from the positive momentum in place to a lesser extent as many key exporters are closing their programs on big water for this crop. Reduced demand doesn’t allow barley prices to see higher than 170+ USD/MT on a CPT basis."

All in all, in the short term, analysts suggest that the Ukrainian grain market will continue to be supported by the strength of the oilseeds. Reduced availability of corn in the direct surroundings of Ukraine will ensure corn remains the driver for the week to come.