CPT prices for Ukrainian new-crop 11.5% wheat should target about 200 USD/MT — ASAP Agri

Since the 2024/25 season's start, Ukraine has already exported around 50% of the wheat export limit set by Ukrainian authorities, meaning that half of the job is done for wheat exporters. With the winter crop planting underway, operators’ attention is gradually switching toward the new season, Olivier Bouillet, the Head of Analytics & Insights at ASAP Agri, told Latifundist.com.

For russia, initial wheat crop expectations for 2025 are not so optimistic, with projections between 80-85 MMT. This is in line with this season's production, but about 10 MMT below record levels. As for Ukraine, thanks to anticipated increases in winter wheat acreage, the 2025/26 production is forecast to exceed the volumes harvested this season.

What to expect in terms of prices?

Ukrainian farmers are currently receiving indicative bids for the 2025 wheat crop on a CPT basis of 195 USD/MT for 2nd-grade wheat, 190 USD/MT for 3rd-grade, and 180 USD/MT for feed grade for delivery in July-August. Meanwhile, current spot CPT prices for milling wheat are seen at 211-214 USD/MT, depending on ports, volume, etc.

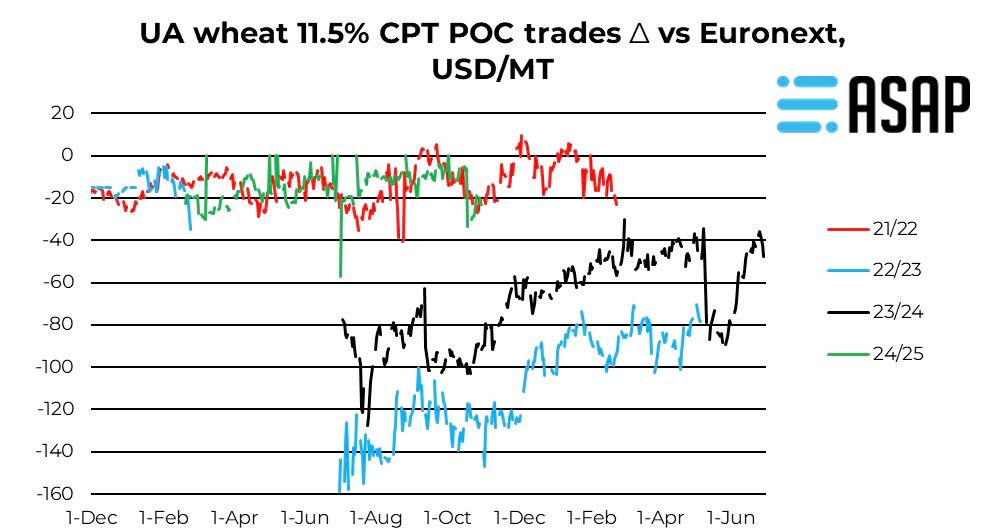

If compared to Euronext September 2025 wheat futures, the Ukrainian new-crop wheat prices are currently offered at a 60 USD/MT discount vs a discount of 25 US/MT for spot prices. This disparity indicates that key exporters continue factoring in substantial risks, which is understandable given the current situation.

Nevertheless, in case of a firm offer for the new crop, the 200 USD/MT level for the 3rd-grade wheat should already be negotiable, Olivier Bouillet stresses.