Rapeseed: Importers Want to Buy, but Sellers Are in No Hurry. How Profitable Will the Crop Be in the 2024 Season?

Prices for Ukrainian rapeseed are rising due to fears of a reduced harvest in Europe. We have heard such opinions from analysts not once over the last two months. So, we reached out to ASAP Agri CEO Christina Serebryakova to explain what's going on with rapeseed prices and demand right now. Director of Agro-Invest, Serhiy Korzh. How told us how profitable this crop has become for farmers in recent years. The company operates in Dnipropetrovsk region that is one of the largest rapeseed producers in Ukraine, and which was affected by spring frosts. What is the expected yield?

What is with the prices and demand for rapeseed this year?

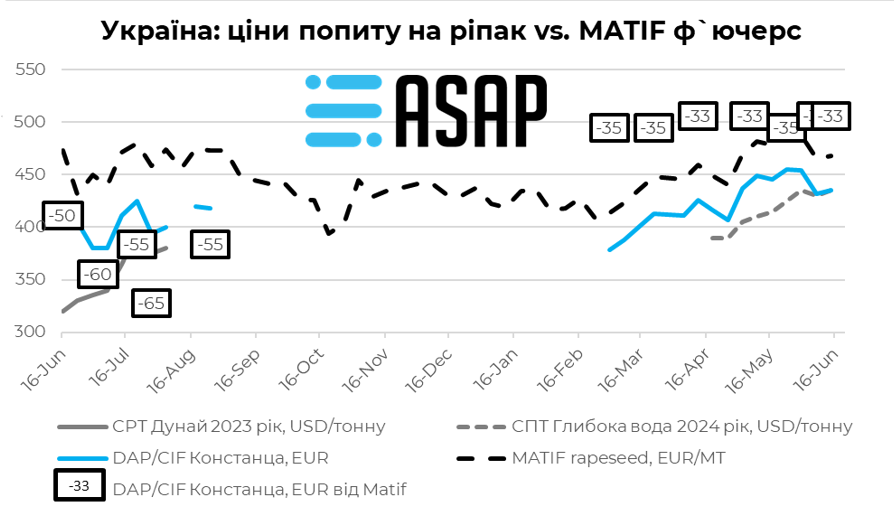

"At the end of May 2024, bid prices for Ukrainian rapeseed on a CIF Constanta basis were already 8% higher than the peak we saw in the summer of 2023," says Christina Serebryakova, CEO of ASAP Agri. "But during the first week of June, the prices lost about €23 due to the pressure from Canadian canola. The canola sowing campaign in the province of Saskatchewan is almost over, and the weather conditions have been favoring the development of the crop," she added.

If we calculate from the premium to MATIF Euronext, then from February to the beginning of April 2024, the price on this basis increased from €379 to €411. Why? Europe realized that the rapeseed harvest in the EU in 2024 will amount to 18.4 MMT against about 20 MMT a year earlier due to a decrease in areas. Then, in April, Strategie Grains lowered the EU rapeseed crop forecast to 18.1 MMT.

Christina Serebryakova

ASAP Agri CEO

"And after that there was a number of problems: the early flowering of rapeseed in Ukraine, which was talked about in mid-April 2024, the problems with the freezing of the crop, which was observed in mid-May. During this period (beginning of April - end of May), the bid price on CIF Constanta calculated from MATIF soared from €426 to €458. This is €32, or 8% higher than last summer's peak."

What do we have now? In the first week of June, the price of rapeseed on CIF Constanta fell by €23 per week due to pressure from Canadian canola, while a reduction of the EU rapeseed crop forecast to 17.94 MMT in June Strategie Grains report limited price losses.

Buyers are interested in signing contracts linked to the MATIF exchange. Especially amid the news that many rapeseed fields in Dnipropetrovsk region were damaged due to local frosts in May.

However, sellers are in no hurry.

Lessons from the past year for rapeseed sellers

"In the 2024 season, sellers are quite cautious when entering the rapeseed market," Christina Serebryakova notes.

Because they had a bitter experience last year, when they concluded forward contracts for rapeseed and rapeseed oil (to China), and then the prices jumped at the time of the execution.

What happened on the market then? As Christina Serebryakova explains, the market is used to the fact that Ukrainian rapeseed is an export-oriented. Most operators reasoned like this: there is a lot of rapeseed in Ukraine and Europe, so the supply exceeds the demand. But what a surprise was the fact that the Ukrainian crushers had been processing rapeseed for more than four months instead of the usual two months. Also, the number of factories involved in processing increased from about five to more than ten. Due to this, domestic rapeseed prices jumped.

So, with this experience, sellers now are holding volumes. It is known that several handysizes/supramaxes/panamaxes were traded to ARAG ports (Amsterdam-Rotterdam-Antwerp-Ghent) in April.

Christina Serebryakova

ASAP Agri CEO

"Of course, the harvesting campaign will start soon and agricultural holdings are already considering sales linked to the MATIF exchange. But there are still few such offers. I think many are waiting for the harvesting to see what happens to the market. And then they will sell calmly, without much risk. In the meantime, the bid prices shown by multinational companies with CIF Constanta delivery are not very interesting for sellers yet."

Economics of rapeseed production

"If the price of rapeseed will be the same when the harvest begins, it will support us a lot," says Serhiy Korzh, director of Agro-Invest.

His rapeseed crop was also affected by frost in May. Also, only 50 mm of rain fell in April-May. Therefore, if the company planned to get 3.5-4 MT/HA, now it is expecting a lower yield.

"I understand that a drop in yield is possible. Although we gave a good boost to fertilizers this year: we saw that the crop was in good condition, so we invested in it. Based on the prices we see now for rapeseed, it should be profitable this year," says Serhiy Korzh.

The enterprise grows wheat, rapeseed, sunflower, corn, peas and oats on 2.1 KHA. This year, due to the autumn drought, only 350 HA were sown with rapeseed. In general, it has been engaged in rapeseed cultivation for about seven years. During this time, thanks to the transition to new hybrids and the improvement of nutrition and protection technologies, it became possible to increase the average yield to 3.3 MT/HA. Winter wheat and peas are predecessors.

As for profitability, the profit from one hectare of rapeseed varies from year to year, says Serhiy Korzh. He gives an example: farmers made a lot of money growing rapeseed in the year before last, then last year they worked almost with no profit.

"This is a very costly crop. If you want to get a result, you have to invest in it. This year, if we take into account all expenses (including rent of land, crop protection, fertilizers, fuel, etc.), the cultivation of rapeseed costs 20000-23000 UAH/HA. Last year it was a bit more expensive, because we spent 14000 UAH only on nitrogen fertilizers," explains Serhiy Korzh.

How to save the rapeseed crop?

As for oilseed crops, Agro-Invest mostly uses Limagrain Ukraine selection (about 200 hectares are sown with it). Serhiy's favourite hybrid is the Architect. This is one of the top Limagrain hybrids, which has been sold on the Ukrainian market for five years. This year, the company also sowed hybrids Artemis and LG Konstruktor KL. Serhiy explains his choice by the fact that the Limagrain selection has a very good resistance to cracking.

"If you have winter peas, winter barley and rapeseed in your crop rotation, then you need to somehow distribute the harvesters and send them firstlyl to rapeseed, so that it does not crumble. Many are probably familiar with the situation when the field begins to "crack" 2-3 weeks before harvesting. The pods crack and the seeds fall to the ground. This is not the case with Limagrain rapeseed. But with other selections, we noticed that they need to be harvested earlier," notes Serhiy Korzh.

As Artem Yuryev, product manager for the development of grain crops and winter rapeseed with Limagrain Ukraine explained to Superagronom.com, the cracking of pods under adverse conditions is quite a frequent phenomenon. And in the case of heavy rains or hail at the end of the growing season, crop losses can reach 30% and even 50%. He even knows cases when agricultural enterprises received 2 MT/HA instead of the planned 4 MT/HA due to cracking.

Artem Yuryev

product manager for the development of grain crops and winter rapeseed with Limagrain Ukraine

"But I would like to emphasize that all Limagrain’s hybrids of the winter rapeseed line have genetic resistance to pod cracking. This is a kind of "insurance" for the preservation of the harvest even under unfavorable conditions at the end of the vegetation."

Serhiy Korzh also noted the genetic resistance of the Architect to the yellow turnip virus and other diseases. "Even if you miss one treatment and the weather does not allow you to go into the field, you will still have a profit, because hybrids have a high resistance to diseases," says the farmer.

What is better not to save on when growing rapeseed?

Agro-Invest works mainly with original crop protection products. Earlier nitrogen fertilizers were applied during sowing, then in the last few years this was abandoned and nitrate and ammonium sulfate are applied to crops since the end of winter. Serhiy Korzh explains his decision by the fact that the company works in a risky farming zone, which makes it difficult to obtain rapeseed seedlings. Therefore, in the case of a bad sprouting, the company will suffer smaller financial losses.

"Rapeseed is quite an interesting crop to grow. Sometimes you can give a smaller dose of fertilizer and have a great crop. We had that with the Architect. The field is medium, we gave a smaller dose of fertilizers. But in the end, we had better yield, despite the fact that we applied 100 kg less nitrate to this field," says Serhiy Korzh.

Serhiy says that you need to take into account the potential of your fields. If 3 MT/HA is the highest level, then you can save on pesticides or fertilizers and get a normal economy. If the potential is 3.5-4 MT/HA, it is better not to save on fertilizers.

"For example, we are now gradually using precision agriculture programs. So, we don't apply the entire norm to one field. We look at zoning: we give more to a better zone, and less to a worse one. After all, no matter how much you add into the worst zone, you will not get the desired result. Therefore, it is better to give in the best," adds Serhiy Korzh.

If the question is whether to save on technology or not, Serhiy advises to take into account the specifics of the hybrid: what is its compensatory capacity, etc. "Everyone builds a strategy for working with rapeseed in their own way," he adds.

Rapeseed sales

Agro-Invest sells a small part of rapeseed to Ukrainian processing plants and transports most of it by its own trucks to the ports of Odesa and the Danube. Logistics now costs 800 UAH/MT to the port of Pivdenny, 1200-1300 UAH/MT to Reni and Izmail. The company also calculated logistics through the western borders, but for now they decided that it is more economically profitable to work via ports.

"It's more productive than working with borders yourself. When you have your own transport you have more flexibility. You are more mobile, you can dictate your own rules. You see a nice price and you have the opportunity to bring a product there. Now this is a very big advantage," says Serhiy Korzh.

Will Ukraine harvest 4.3 MMT of rapeseed?

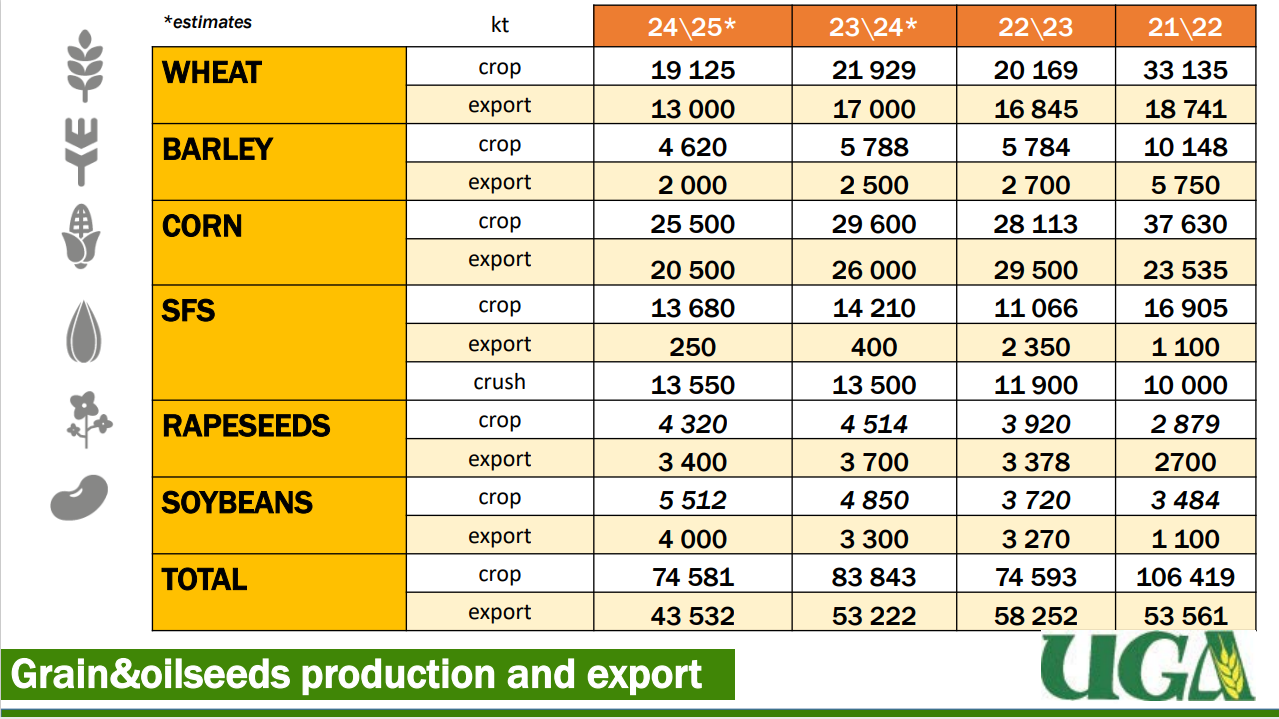

According to the latest reports of the UGA, the rapeseed harvest is expected to be 4.3 MMT in 2024.

Christina Serebryakova was surprised by such optimistic forecasts. According to her, the USDA forecast at 3.7 MMT is the most realistic.

Christina Serebryakova

ASAP Agri CEO

"Strangely enough, this forecast appeared even before the market operators started talking about the problems with rapeseed in Dnipropetrovsk region. But these 3.7 MMT, in my opinion, are the figures closest to the market situation. We will be lucky have 4.3 MMT. But by what means? I do not know. Because the early flowering and the frosts that hit the rapeseed will definitely not let to have yield at 3 MT/HA."

Natalia Rodak, Latifundist.com