1000 Hryvnias: in the Rich Man's World

In December 2016 in an interview the Head of the National Bank of Ukraine Valeriia Hontareva has mentioned that the regulator is going to add the new nominal value of UAH 1,000 to money turnover in the nearest future. NBU justified the issue of the new banknote by the fact that it will make cash payments of economic agents easier. At the same time, the market fears devaluation and the growth of shadow economy. That is why there are no large denominations in the developed countries. Latifundist.com decided to examine and assess the impact of this move of the National Bank on the national economy in general and the agricultural sector in particular.

Agrarian Aspect of the Problem

According to the Deputy Chairman of the National Bank of Ukraine Dmytro Solohub, calculations that were made taking into account changes in the monetary base and the level of prices confirmed the necessity for a bill "1000 Hryvnia."

Such actions do make the cash turnover for agricultural companies easier, Andrei Blinov believes.

‘It is well-known that agricultural companies, especially farmers, pay mostly in cash. In this case, bundles of money are fairly thick and weighty, containing a small sum of money — $200 or $ 400. Talking about payment to employees, if it is the new minimum wage in 3200 UAH, it requires a minimum of 7 banknotes’, — the expert said.

In the case of farmers, as well as with other entities, the change of the monetary denominations can worsen their economic expectations, which is not very optimistic in Ukraine. Regarding the crucial importance of the agricultural export (according to the National Bank, AIC and steel industry accounts for 90% of Ukrainian exports), these expectations may have an effect on the financial and economic situation in the country.

The agricultural activity requires detailed planning and significant funding, which depend on an exchange rate. Prices for seed, fuel, farm machinery and plant protection products are also closely tied to the exchange rate. Finally, the industry has always felt the impact of exchange rate fluctuations, particularly during the sowing campaign.

According to the Head of the Analytical Department of Consulting Company AAA Mariya Kolesnyk, new banknote won’t impact upon the agricultural market.

‘Firstly, the farmers do not keep the money in national currency, and secondly, the shadow market of grain is based on currency payments because of currency risk, and the sale of goods and the continued use of money are separated in time’, — the analyst said.

Moreover, Mariya Kolesnyk advises not to worry about corrupt officials. Because bribes, if they are given in cash, are not in local currency. At the same time, the majority of agricultural enterprises make non-cash payments. Therefore, introduction into circulation of the new bill with denomination ‘1000’ can only create additional difficulties in paying wages to employees, provided that it is not transferred to the card.

Some well-planned nuances influence the supply of agricultural products to the internal and global markets, the effectiveness of farmers, prices and foreign exchange earnings to the country. And in the context of the recent negative currency trends, farmers can play a key role, both positive and negative.

According to Deputy Director of the Institute of Agrarian Economy and Expert of ‘Independent Expert Partnership’ Vitalii Sabluk, there is no link between the introduction of the new banknote and the development of the agricultural sector.

Dmytro Sologub claims that the nascent gap between cash and non-cash exchange rate at harvest time in midsummer and at the end of autumn in 2016 is a testament to the fact that 15-20% of the harvest-2016 passed through the cash or black market. In this case, the new bill could make such transactions easier, and this ratio in 2017 might be higher.

But Olexander Parashchii, Chief of Analytical Department of Concorde Capital, sees no prerequisites for enhancing the shadow economy in the agricultural market in light of the new banknote’s issue.

‘From the beginning of 2014 inflation rate in Ukraine is 100%: goods that could have been bought for 500 UAH three years ago now cost 1000 UAH. Therefore, there is nothing strange about issuing the 1000 Hryvnia bill’, — the analyst says.

According to Olexander Parashchii, simultaneous emission of large bank notes and setting the limit for cash payments in the sum of 50 thousand UAH looks ambiguous. It turns out that the wad containing 100s and 500s is the permitted maximum of cash payments. There is no need to introduce a bill larger denomination for cash payments.

Currency of Ukraine

According to the National Bank of Ukraine, as of October 2016 there was 312.5 billion cash, of which 310.4 billion banknotes and about 2 billion coins. There are 3 billion banknotes of 1, 2, 5, 10, 20, 50, 100, 200 and 500 UAH and over 12 billion swap coins of 1, 2, 10, 25 and 50 coins and circulating coins of 1 UAH.

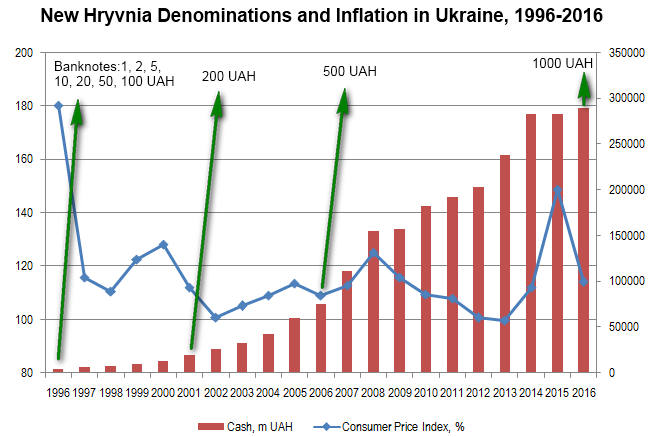

The National Bank of Ukraine has been renovating Hryvnia notes for several years. Thus, 100 UAH of the 2014 series was added to the turnover in March 2015. It was attributed to the fact that 100-Hryvnia banknotes along with 20s and 50s were counterfeited most frequently. Banknote ‘100 Hryvnia’ was issued into circulation with all the smaller denominations in September 1996, during the monetary reform in Ukraine.

The next largest denomination — 200 Hryvnia — was put in circulation in 2001. By this time, the average monthly salary in comparison with 1996 has increased by 2.5 times and amounted to 311 UAH. Over the six years, the Ukrainian currency against the US dollar passed the position 3 times — from 183 to 537 UAH.

The largest denomination — 500 Hryvnia — was put in circulation in September 2006. At that time, the 500 UAH cost $99 and €79. Then, the average monthly salary in Ukraine amounted to 1041 UAH.

At the beginning of January, the Deputy Head of the NBU Dmytro Sologub confirmed that the central bank had been working on issuing of ‘1000 Hryvnia’. For the first time, ‘1000th bill’ was mentioned by Sergei Arbuzov, ex-chairman of NBU. Justifying this step, then, as now, the management of regulator referred to the substantial depreciation of the Ukrainian money.

Furthermore, in 2015 Sergey Arbuzov showed a possible design of the new note, adding that it could have played an anti-inflationary role.

‘The new bill is necessary for quite a long time and it is a result of inflation and jumped price scale — Andrei Blinov says — it is thought that the norm for minimum payment is 2-3 banknotes. From this perspective, we will get the weight of the pack with the money and the wear of 50s, 100s and 200s reduced. In countries with stable economic system, small denominations are the most widely used, for example, $20 in the USA. But in Ukraine, it is 200 UAH. In fact, a big demand for 200s is due to the fact that there are not enough large denominations’.

New Banknote: Making Decision

In general, the structure of denominations has a simple task of cash payments convenience. Current denominations are designed to ensure that the buyer and seller can always be square up.

It is said that the structure of the money supply is rational, if the calculated average value of banknotes is as close as possible to the most used denomination in turnover. NBU data shows that 200 UAH is the most widely used bill. According to the simple calculation based on weighted arithmetic mean, the average denomination in the country today is 112 UAH. On the one hand, this calculation has some deficiencies. But at the same time, taking into account the results of the calculations, we can admit that framework of cash money in Ukraine is more or less optimal now because 112 is not too far from 200. Yet adding 100s and reducing the number of 200s and 500s would not hurt.

However, such calculations would never show the need for a larger denomination, for example, 1000 UAH. It is aimed at improving the framework of the existing denominations. The average amount of cash payments in the country can justify the necessity of the new bill. But we have sent our request to the National Bank to announce this data and specify the reasons for improving the structure of denominations. The request was left unanswered. The officials of NBU only noted that ‘...information about new banknotes is a state secret’.

By the way, $100 is the maximum banknote in the United States for almost 50 years. In 1969, bills of $500, $1,000, $ 5,000, $10,000 and $100,000 were withdrawn due to their lack of use.

Nominal Effect

When it comes to the notes of bigger nominal, officials usually point out a significant change in the price scale. There is no doubt that it is about Ukraine. Since 2006, when the maximum denomination was issued, Hryvnia rate fell by more than 5 times in relation to the US dollar and more than 4 times to the euro. Inflation in Ukraine, according to the Consumer Price Index published by the State Statistics Committee, has already exceeded 400% over the past 11 years.

At today's prices, the bill of 1000 UAH can be exchanged only at $37 and nearly €34.5 (as of 31 January 2017). The average monthly salary of Ukrainians, according to the State Statistics Service, from January to November 2016 reached 5070 UAH. Indeed, the arguments for the introduction of a new denomination are more than convincing.

Nevertheless, a significant part of experts considers putting new denomination in circulation at least premature and anticipates problems.

This is due primarily to the fact that convenience of cash payments is not a priority of the National Bank. Contrariwise, the National Bank must be interested in increasing non-cash payments. The National Bank of Ukraine has recently recorded a steady increase in these payments and even developed a strategy to reduce cash payments until 2021. In spite of all this, Ukraine together with Belarus and Moldova were the leaders of the ratio of cash to GDP last year. Thus, the path to a cashless economy in Ukraine won’t be quick.

For Whose Benefit?

The excess cash in money circulation significantly complicates the conduct of monetary policy. Firstly, cash serves for the shadow economy, which, according to various estimates, is up to 40% in Ukraine. By the way, the bill of 500 Euros is withdrawn from circulation because counterfeiters and drug dealers use it widely.

It is believed that the large denomination notes are used in illegal transactions. According to research of the John F. Kennedy School of Government, 60% of the criminal transactions are provided in cash, and large denominations should be prohibited in the fight against organized crime.

Secondly, monetary policy has no effect on the cash turnover: cash cannot be "expensive money" or "cheap money", because it is already in the purse. That is why reducing the limit on cash payments to 50 thousand and almost simultaneous issue of the new nominal looks at least contradictory.

Experts also point out that the issue of new banknotes may mean printing money. To judge anything is difficult, because on the one hand, the National Bank denies this fact, and on the other hand "money economy" has remained an enigma in Ukraine. We do not know what is more profitable, for example, to print more 200s or 500s.In addition, then issue of a new bill gives an inflationary signal to the householders and businessmen.

The highest denomination bill in the world has 14 zeros on it — banknote of 100 trillion Zimbabwean dollars. And this is one of the classic cases where the increase in the nominal value of banknotes has been associated with hyperinflation.

The new large denomination often has a negative impact on the rating of the current government, and presidents of all counties are trying to slow down this process. Considering the (in)action of ‘decisive reforms team’, we might admit that the President of Ukraine wouldn’t spoil the reputation, as much as possible postponing the issue of the new banknote.

We will to hope that the bill ‘1000 Hryvnia’ signed by Valeria Gontareva actually makes cash payments more convenient and it won’t bring a new phase of inflation and exchange rate neither to farmers nor to consumers of their products.

Viktoria Kremen, Latifundist.com