Grain Pyramid: The Agroinvestgroup Fraud

Market operators confirm that the Ukrainian grain market is becoming more civilized, and it is driving out fraudulent players. However, the purification process is still at full blast. There are cases when even by all possible outward signs, a healthy company suddenly turns out to be insolvent and may get away with contractors' money at one point. The history of the Odesa holding Agroinvestgroup supports this fact.

Immediate reaction force

On January 31st, 2019, the operators working with the Agroinvestgroup began raising the alarm. According to the counterparties, the holding ceased to pay under contracts, meanwhile, the owners and the management of the company and its structural divisions vanished.

Spokesmen of financial institutions-creditors for Agroinvestgroup also reported that the Group stopped paying the debts and had gone silent. It became known from users of the Black List and Grain Traders of Ukraine Telegram channels that the owners discharged the company's staff.

On February 1st, Agrarian Fund PJSC announced the possible theft of its grain stored at a number of elevators controlled by Agroinvestgroup. According to the representatives of the Agrarian Fund, the security service prevented them from carrying out a scheduled inspection of the grain storage enterprises, which the Fund has the right to conduct monthly. The Agrarian Fund states that in the case of grain appropriation or theft, state losses will reach UAH 200 million.

The national police initiated criminal proceedings and on February 4th launched an investigation into the theft of property by the Agroinvestgroup officials. What is more, on February 7th, the Fund's operations were blocked by the detectives of the National Anti-Corruption Bureau of Ukraine (NABU). The Executive Director of Agrarian Fund PJSC Nikolai Zubarev considers the current searches by NABU in the office of the Agrarian Fund not coincidental especially followed by the statement about the disappearance of the state company's grain at the Agroinvestgroup elevators.

“One may mistake this for a coincidence. I am sure it is not. No match for dates or numbers is possible. A few days ago, we discovered produce shortage at the Agroinvestgroup elevators, which are located in the Odesa region, and began taking immediate actions to save whatever was left there. This is about 27 thousand tons of grain belonging to Agrarian Fund PJSC. We appealed to the National Police, the Security Service of Ukraine, and the Prosecutor's Office. That grain is worth UAH 200 million. That is exactly the amount that appears in the criminal case by NABU on mineral fertilizers. Hardly it is a coincidence. Perhaps, these cases are indeed interconnected, and someone does not share our intention to save the state property,” Nikolai Zubarev explained in a commentary for Latifundist.com.

Law enforcement officials block the work of the defrauded enterprise instead of having an investigation. This is a startling coincidence.

Agribusinessmen who stored grain at the holding's elevators might also demand losses set-off in the courts. Moreover, the President of the Ukrainian Grain Association (UGA) Nikolai Gorbachev informed that already 17 companies filed complaints with the police.

It is notable that a number of companies have worked with Agroinvestgroup for at least ten years. Market participants affirm that the holding was sometimes late on payments, but generally, contracts were always executed.

The Ukrainian Agri Council (UAC), with the proviso that the information is unconfirmed, reported that the management of the Agroinvestgroup company exported 90% of the products from Belgorod-Dniester Elevator, Izmail Elevator, Raukhovsky Elevator, Aliyag Elevator, Zaplazsky Elevator, the total storage capacity of which is 300 thousand tons of grain.

According to the director of the company, which stored grain at the Agroinvestgroup elevators, the latter acted like the actual owner of the crop and exported the clients' products from their storages.

“This is your elevator, you just load someone else's grain, and indicate it in the documents as yours. Many elevators do so: they sell someone else's grain at a good price, then compensate the shortage with their grain. But this is a situational thing, and here is a smooth running operation,” he says.

As Nikolai Gorbachev explained, the scheme used by the Odesa company has much in common with the MMM pyramid.

“Well, this is like the MMM pyramid when one enters the storage and sees his 3,000 tons. But no one knows how many warehouse receipts are written for this grain. And apparently, they made 5-6 times more warehouse receipts, than they actually had grain. Therefore, when all the owners of the grain announced what volume of their grain is stored, it turned out that there was no grain at the elevator, and probably never was,” the UGA President stresses.

In fact, the company attracted a financial resource, underpinning it with double and simple warehouse receipts. Simply put, companies gave money to Agroinvestgroup on the security of grain in their elevators. These are forms of strict accountability that are entered in the registers on the website of the State Register of Ukraine. Representatives of several companies admit that after the news of the Agroinvestgroup bankruptcy, they addressed the registries. Except their warehouse receipts were not registered there.

“They were simply forged,” a company representative complains.

Response

The situation developed dashingly. And on February 5th, two meetings were held in Odesa and Kyiv. The Kyiv event was organized by the National Police, the Odesa meeting — by the Ukrainian Grain Association (UGA).

More than thirty market participants gathered at the meeting in Odesa, those were farmers, representatives of multinational and Ukrainian large agricultural companies. It is worth noting that among the defrauded were such transnational companies as Bunge, Delta Wilmar, Soufflet Group, CHS and others.

The UGA President Nikolai Gorbachev asserted that the damage from the fraudulent actions of Agroinvestgroup officials is estimated at USD 100-120 million. The meeting participants believe that more than 20 companies from different countries are affected by the Odesa company's scam. By the Latifundist.com information, the Group’s debt owed to banks ranges within USD 38-42 million. The debt to international funds providing trade finance, among which the lion’s share is to the British Arkadia fund, reaches tens of millions of dollars. It also became known from those present at the meeting that the owner of Agroinvestgroup Nikolai Kucherenko and his son Vitaliy fled on February 1st to Riga (Latvia).

The UGA is resolute. In particular, Nikolai Gorbachev said that after the total amount of the company’s debt to creditors is determined, the assets value estimation would be due.

“I recommend to prepare documents and to have the patience for continued negotiations,” the UGA President concluded.

A week ago, the National Police reported that agricultural companies were unable to get to the grain storage facilities for the Agroinvestgroup security guards blocked access to the elevator. Today, at some elevators there are policemen and the SFS officials, along with private security from banks at others. Since February 2nd, shipment is nowhere carried out. Therefore, operators hope that some part of the grain is secured there. Hardly will there be enough grain to cover all losses.

A rosy picture

The group of companies "Agroinvestgroup" is registered in Odesa with a statutory fund of UAH 53 thousand. As stated on the company's official website, it was founded in 2008 and is currently one of the largest agricultural holdings in southern Ukraine. The Group cultivates more than 30 thousand hectares in the Odesa region and operates more than twenty grain elevators. Most are floor storages or old warehouses, and there are at least eight modern elevators.

According to the financial accounting of Agroinvestgroup for the year ended June 30th, 2017, which Latifundist.com has at its disposal, the Group began the process of declaring bankrupt Zaplazsky, Belgorod-Dniester, and Aliyag enterprises to change the legal status from joint-stock companies to limited liability companies.

It was stated that all assets and operations of these companies were transferred to other companies of the Group. For the year ended June 30th, 2017, the process of declaring the companies bankrupt was not completed due to ongoing litigation with Delta Bank. This financial institution initiates legal proceedings in order to invalidate the offsetting of deposits with the remaining credit indebtedness and accrued interest.

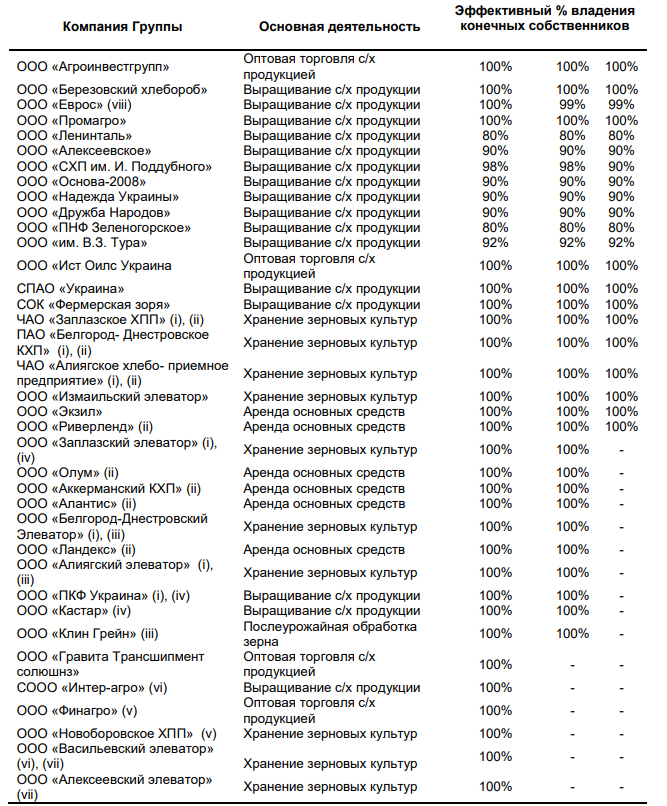

As it is stated in the document, as at June 30th, 2017, the Group was not fully structurally integrated within a legally registered holding and did not have a common parent company.

At that time, the structure of the company was as follows:

According to the financial accounting for the indicated period, the revenue of Agroinvestgroup stood at USD 73.6 million, the cost of non-negotiable and biological assets was USD 13.6 million. As of June 30th, 2017, the company's loans and borrowings were estimated at USD 25.1 million. Agroinvestgroup was provided with credit lines at the State Savings Bank Of Ukraine (Oschadbank), Tascombank, Diamantbank, Vostok and OTP Bank.

The YouControl analysts' calculations provided to Latifundist.com indicate that FinScore's index a year ago demonstrated a deterioration in the financial health of Agroinvestgroup and an increase in the probability of default on obligations.

At the beginning of 2018, 77.3 pct of Agroinvestgroup assets showed financial performance below average values in the markets. The results of the audit of the Group’s companies using the Express Analysis module of the YouControl analytical system proved there is a number of non-financial factors that are signals of an early indication for the company's reliability. So, the overwhelming majority of the top ten leaders of the Group showed a tax debt. Indicators such as limited competence of officials, recent management change, insufficient statutory fund, offshore owners, as well as factors indicating a negative court practice worked quite often.

As indicated in the YouControl analytical system, Nikolai Kucherenko is the owner of Agroinvestgroup. Market operators who personally knew and directly communicated with father and son, Nikolai and Vitaliy Kucherenko, noted that working with these businessmen was not a matter of concern.

The market by default considered that the father was engaged in agricultural production and elevator business, and his son was in charge of trading and attracting financing. Market participants say that in the case with Vitaliy, the “Nikolai Guta phenomenon” played a key role: a charismatic businessman with a Western education who was taken on trust. He personally participated in all the decisive meetings with creditors and key partners.

A possible denouement

Market participants suggest that Agroinvestgroup may end up like the Odessa Oil and Fat Plant (by the YouControl, Odessa OFP is the Agroinvestgroup subsidiary), which bankruptcy procedure was launched in 2016.

In 2011, Delta Bank redeemed debts from Ukreximbank, including the debts of Odessa OFP. At the same time, when in 2015 the NBU decided to liquidate the bank, the OFP (where Nikolai Kucherenko was the member of the Supervisory board), did not pay debts. In 2016, the Economic Court of the Odesa region opened the bankruptcy proceedings of the Odessa OFP, thus granting another Group's subsidiary claim, Lenintal. The OFP owed UAH 501.8 thou. to Lenintal.

On the court decision, in July 2016, sanation of the OFP was initiated, which was suspended in November 2017. The company was declared bankrupt. On January 25th, 2019, the liquidator filed a motion to extend the deadline for the liquidation procedure for six months. The court granted an extension of two months until April 1st, 2019.

Other consequences

In spite of the fact that all the affected parties intend to seek compensation for damage, it is unclear how they will make it happen. Experts believe that not all defrauded international companies will be able to obtain compensation through insurance companies. Not to mention a few small farmers. Although separate market participants admit that the owner of Agroinvestgroup can still pay off local businessmen and be waived the debts by the international companies.

In order to protect themselves, grain buyers will reduce purchases of products at elevators and pay only for customs cleared goods, Nikolai Gorbachev believes.

“If the aggregate level of grain exports equals to USD 6-8 billion a year, then with a turnover reduction, I think the Ukrainian market will feel a shortage of funds for the purchase of grain produced by agricultural enterprises,” the UGA President insists.

However, some market participants do not consider the situation pre-planned. One of Odesa farmers told Latifundist.com that Nikolai Kucherenko contacted him yesterday. The owner of Agroinvestgroup claimed that he had been framed. At the same time, he promised to make a statement about the true causes of the situation, pay off with the farmers, and support the region.

Needless to say, the Agroinvestgroup case will have a negative impact on the image of the domestic agrarian industry and not only. Nikolai Gorbachev expects that some transnational companies will significantly reduce investment in Ukraine. Which in turn may lead to a production drop and loss of market development dynamics.

The case is long-life, so we will keep abreast of events. For the record, Latifundist.com repeatedly suggested through the Kucherenko entourage that he or his son should pronounce themselves. No answer has been received so far.

Konstantin Tkachenko, Alla Sylyvonchyk, Latifundist.com