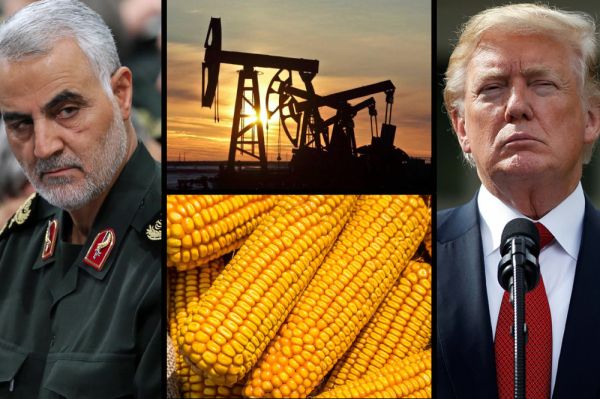

Grain and the City: Trump Cancelling the Spring

Since the beginning of the week, oil prices have dropped sharply by about USD 1.5 after Trump’s twits that the stakes are getting too high.

Oil prices getting too high. OPEC, please relax and take it easy. World cannot take a price hike - fragile!

— Donald J. Trump (@realDonaldTrump) February 25, 2019

This is the thing from the December meeting of OPEC+ "to understand and got to forgive." Usually, Trump argues on American schists producers and how they lead the United States to a net exporter of oil position. At the end of 2018, OPEC+ agreed to reduce oil production by 1.2 million bpd in the first half of 2019, of which 0.8 million bpd will fall in the cartel and the rest — to Russia and co. While oil is falling, there are over half a billion dollars left without buyers after the sanctions rollout Washington's side in January near Venezuela in 16 tankers. Without financing for many of US processing plants and trading houses, PDVSA has trouble finding buyers. Shipments are made only to India and China in exchange for loans previously provided.

Friday will be interesting. Firstly, it’s spring, finally. So somewhere there must be Shrovetide. When? I want to burn a couple of scarecrows. Secondly, the data on the growth rate of US GDP in the fourth quarter will be published, which may well disappoint, given the weakness of the figures for retail sales and the residential real estate market. And, what’s the most interesting, the first-of-March is the starting point of the new stage of the trade war.

Trump has already announced to all that he is very happy to abolish the duties and bury the hatchet of the war, which he actually lost. China allegedly buys 10 million tons of soybeans. In exchange for what is yet unclear and the time frame being a mystery, too. The fact that it does not save in any way from an excess of beans in the warehouses of American farmers, no matter how much he praises them, does not interest anyone. 10 million tons compared to 20 million on the same date last year — this, of course, is an achievement. Especially considering that even if they sell, it is not a one-shot. Strong business executive, words are not enough. Many of his actions have a simple logical explanation: “I’ve flipped out.” The main thing is to live until Monday.

According to AgRural, Brazilian soybeans price has grown a bit. The guys are actively trading. Chicago is surprisingly calm. The cash market is globally more red. Easy mistake: soy is an unholy mess, corn is overproduced, and wheat rose to the limit. From the first according to the logic of things, everything should not be green, but here trumpochina rules the ball. Mr President said again that China is "way too close to the agreement". Hardly anybody believes it way too much. With corn, there is nothing to expect. But for wheat, there may be surprises.

No news on India. It is not clear at what stage the phytosanitary of Ukraine and Indonesia are. Everything is clear with Australia — it’s burned out there. Argentina is trading. In Ukraine, there is about 1 MMT/month before the end of the season. In Russia, export rates were higher than last year, the domestic price tag warmed up and smashed into the buyers’ capacity. Stocks are a third lower than last year, and everything looks very ambiguous. It’s as if in the Russian Federation they are trying to warm up market interest with news, numbers and charts. Their agriminister holds high hopes for a new traders association. So what's wrong with the old one? I have already ceased to ask the question "where is the justice?" One should first understand where the logic is.

Argentinean corn is beautiful. In Brazil, ethanol is also famously produced. Famously means a forecast of 1.4-1.5 billion litres in 2019. Ukraine sold a little more than 12 MMT. Prices are declining, export rates are falling like February snow. China tried to cheer everyone up with the news about Uruguay, but it’s empty and sad. India wept and fell silent. What can I say? Corn nachos with avocado sauce is delicious. Let’s wait for the harvest of avocados.

And it's high time to remember that barley is coming. In the sense that now is the time when you can contract the still available Ukrainian barley. The life of traders there is interesting but nervous. Therefore, they are cheery but angry.

But soybean oil sagged after the oil. The rate of Malaysian palm exports is down. From 1 to 25 February 2019, shipments decreased by 5.5% compared to the same period in January and amounted to 1.14 MMT. There is good potential for the growth of other vegoils, but not everywhere. It is possible to slip into China with 100 thousand tons of palm purchases against 223 thousand tons from January 1 to January 15, or to the European Union — 264 thousand tons in February against 302 thousand tons in January. However, this trick may not work with India: the country and its neighbours bought almost twice more in February than in January — 435 thousand tons. All is not lost. There is still left much to lose.

On Sunday, the Oscars were given out. Not exciting at all. The films are not so hot, and the dresses were so-se. Billy Porter’s was the most decent one. Elegant, unpredictable. This is not grain trading. Wait until the spring aggravation hits, and we will generally live successfully!