Thumbs up or Thumbs Down: Does the Booming Corn Export Endanger the Domestic Market?

Infographic guide Ukrainian Agribusiness 2019/20

In early November, Ukrainian livestock farmers addressed the Prime Minister Denys Shmyhal and the Minister for the Development of Economy, Trade and Agriculture Igor Petrashko requesting to include the total annual volume of corn export into the Memorandum on the coordination of positions on the grain market. The aim is to prevent further increase in the price of mixed feeds and shortage of forage grain on the market. The relevant letter was sent by Poultry Union of Ukraine and the Pig Breeders Association. Latifundist.com undertakes to find out whether the country may face a deficit of forage grains.

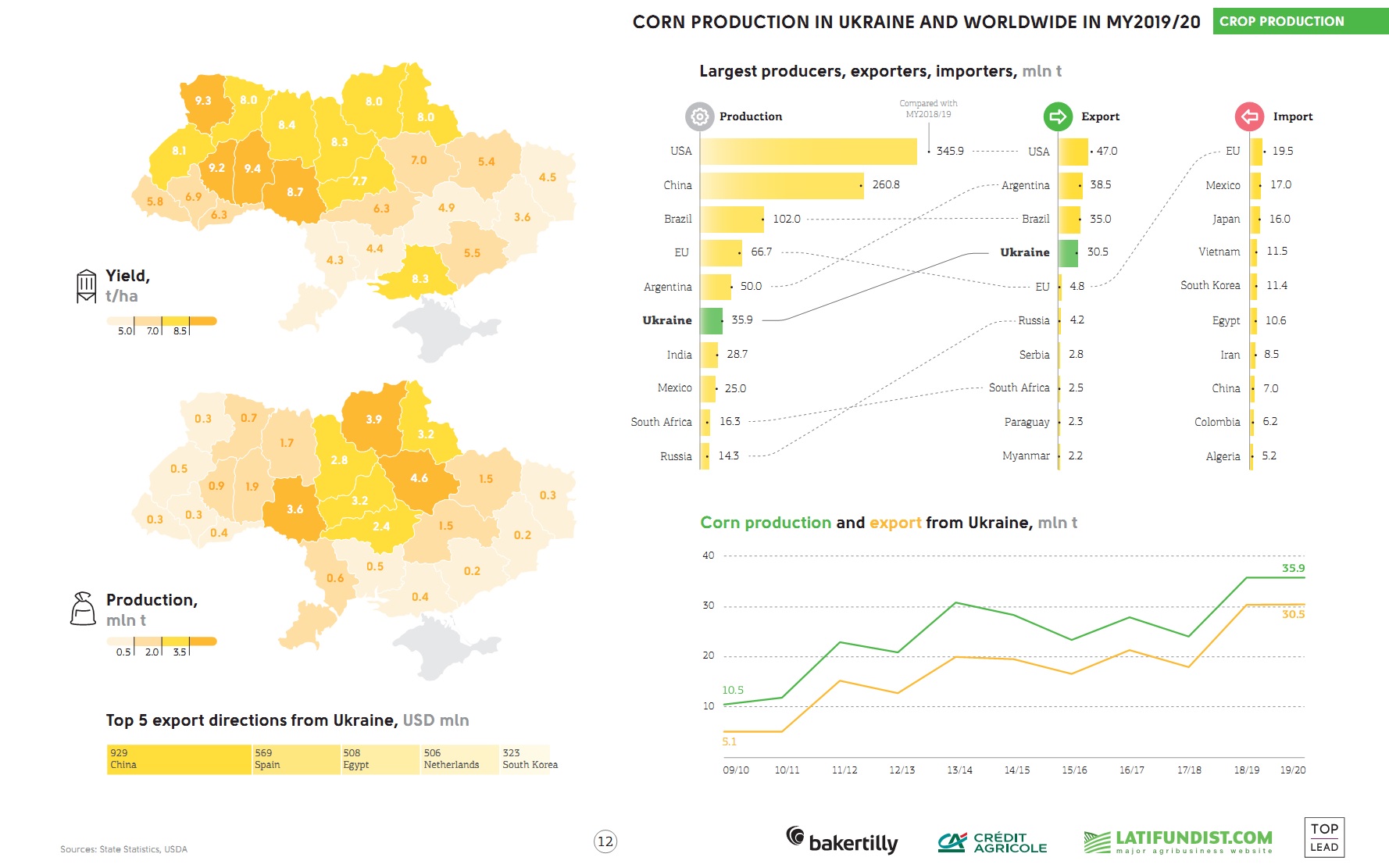

Yield

In the November USDA report, corn production 2020/21 in Ukraine was reduced by 8 mln t, or by 22%, to 28.5 mln t (36.5 mln t in the October report). This is despite the fact that in the current season the total corn production areas have been increased to a record 5.5 mln ha. The reasons for the yield drop are obvious: the severe drought in August when corn needs to absorb plenty of moisture for filling. The central regions, where corn literally 'burned', were damaged particularly hard.

Related: TOP 10 Corn Producing Countries in 2019

Export

Last year Ukraine was among the top three world corn exporters. How are exports going today against the background of declining yields? According to the Economy Ministry data, as of November 11, 3.4 mln t of corn were exported, which is almost 2 mln t less from the corresponding period in 2019.

As BarvaInvest CEO Volodymyr Humenyuk noted during the Ok Agro agrarian business conference, Ukrainian grain traders are to ship 10 mln t of corn for export in the nearest future.

"Traders expected this season's corn production at 40 mln t and export at 33 mln t, consequently these volumes were taken into account in October-December contracts. Now we see that production will be around 28 mln t and export 22 mln t. But the contracts have to be fulfilled. In the nearest future, we have to ship 10 mln t. For the last 10 years, there was no such case that during three months half of the corn volume was exported," he reminds.

Ukrainian cattle breeders are also concerned about the vigorous export of corn from the country. In their appeal to the PM and the Economy Minister, they emphasize that the active export of corn may recur the situation of 2003 when the country had to import corn.

Learn more: Corn Exporters from Ukraine in 1H 2020

They add that the previous marketing year from the produced 35.9 mln t of corn 30.3 mln t were exported, which, given the domestic demand of 7.0 mln t, led to the reduction of carryovers and price growth in April-May caused by the minimum supply on the market.

"This year, the Economy Ministry forecasts corn yield at 33 mln t. The market experts are more pessimistic in their estimates and put it at 27-28 mln t. Now there is an active export of corn as it is being harvested. As of October 23, 10 mln t of wheat were exported which makes up more than a half of volume agreed in the grain memorandum signed by the Ministry and market participants for 2020/21," the statement reads.

Feed price increase

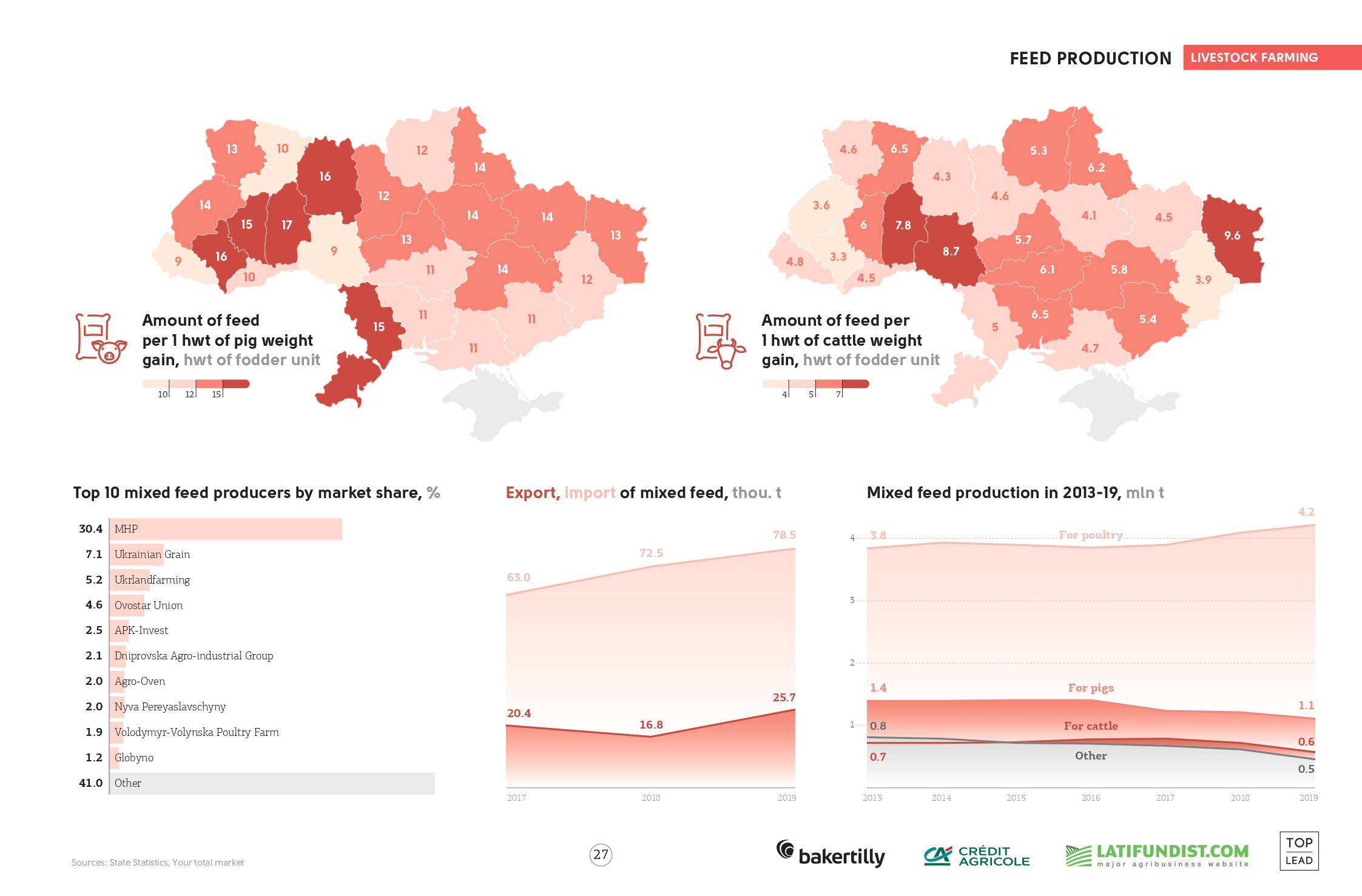

Producers are convinced that the rapid growth of Ukrainian corn export may prompt grain shortage in the domestic market within a couple of months and, as a result, the prices will go up. They note that over the last two months, a rapid rise in price for forage grain, which is used in animal husbandry for mixed feed production, was observed.

"Growth in the price of mixed feed, which accounts for 65-70% in the structure of poultry and pork production costs, leads to higher production costs in these industries. Comparing October price trends in the procurement of staple grains with those of last year, we note the rise in purchase prices for forage corn by more than 65%, forage wheat by 57%, sunflower meal by 39%, soybean meal by 42%. Accordingly, the cost of finished feed surged by 40-45% YoY," producers stress in their appeal.

The same situation is observed in poultry farming. Growth in production costs will lead to the unprofitability of poultry meat and eggs production in Q4 of this year and it will remain unprofitable thereafter if prices are not increased significantly, they say. Currently, meat production sustains 12% of loss, eggs production 17%.

Another indicator that confirms the crisis situation in the industry is the prices for finished poultry products. Thus, the average selling prices for poultry meat in September 2020 decreased by 15% YoY. And the average annual selling prices for eggs, as provided by the data, decreased for the third consecutive year: by 12%, 15% and this year by 13%.

According to Maxigrain business development manager Elena Neroba, the rapid growth in the cost of raw materials for feed in Ukraine is caused by the combination of two factors: internal — corn and oilseeds crop failure, and external — Chinese demand driven by the improved situation with ASF.

According to UkrAgroConsult analysts, in October China intensified import of Ukrainian corn by 4x to 721 thou. t and so the country's share increased to 38%. According to the November USDA report, the total volume of coarse grain exports to China will reach a record 26 mln t, slightly higher from the previous maximum of 25.7 mln t in the 2014/15 season.

Livestock farmers' suggestion

| Poultry Union of Ukraine and the Pig Breeders Association request to limit the total annual volume of corn export in the Memorandum on the coordination of positions on the grain market. |

Moreover, the cattle breeders remark that they are no supporters of any export restrictions, but in case of violation of the balance indicators, they will be forced to apply to the country's authorities with a request to intervene and carry out state regulation measures to provide the livestock industry with coarse grains in required volume, namely 6.5 mln t.

Food security risks

The Ukrainian Grain Association (UGA) mentions that Ukraine produces three times more grains and oilseeds than it actually requires. Under the statistical data, over the past few years, the yearly crop production totals 85 mln t, while consumption does not exceed 30 mln t. The year 2019 was record in this regard: production reached 98 mln t and export 62 mln t. The Association explains that the country is forced to export surplus grains and oilseeds as it is unable to utilize so much raw materials itself, besides, it brings additional funds to agriproducers and the country.

"In 2019, Ukraine earned more than USD 9.6 bln from the export of grain crops and was ranked second in the world after the United States by this indicator. In general, exports of grains and oilseeds, including products of their processing, bring about USD 16 bln annually. The total agricultural commodities export provides more than 40% of foreign exchange earnings and is the basic factor today in supporting Ukraine's economy. What's more, Ukraine has a significant potential to improve the volume of grain production by increasing the yield of crops," the UGA added.

Elena Neroba believes that export restriction to moderate prices in the domestic market is a state intervention and rejection of a free market itself.

"I remember when they attempted to limit the export of soybean and rapeseed, the producers were the first to respond by reducing sown areas. The state can only support certain kinds of business or segments of society, but taking only a balanced approach. Or better yet, if the state creates conditions that do not require international contracts for people with low income to buy meat and eggs," she concludes.

To be continued...

Natalia Rodak, Latifundist.com