Kernel reports 31% drop in FY2020 net profit

Kernel reported USD 123 mln of net profit in FY 2020(July 2019 – June 2020), 31% lower YoY (FY 2019: USD 179 mln).

The company's revenue for the period increased by 4% YoY to USD 4.11 bln (FY2019: USD 3.96 bln). The gross profit boosted by 38% to USD 462 mln (FY2019: USD 334 mln), operating profit by 25% to USD 337 mln (FY2019: 269 mln).

Kernel's EBITDA in FY2020 also improved having reached USD 443 mln or 28% YoY (FY2019: USD 346 mln).

Segments' revenue performance in FY2020:

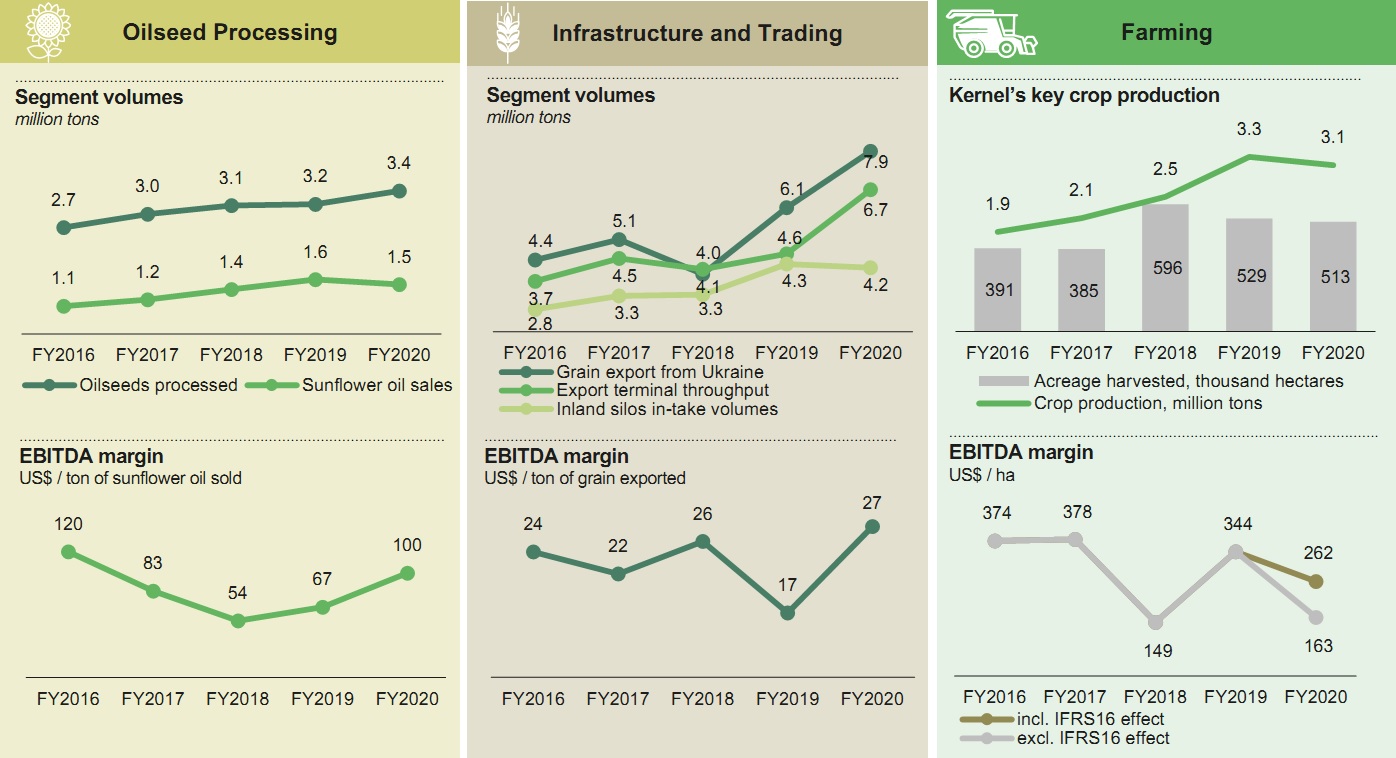

- oilseed processing: revenue demonstrated a 4% improvement to USD 1.55 bln (FY2019: USD 1.493 bln)

- infrastructure and trading: a 10% increase to USD 3.43 bln (FY2019: USD 3.108 bln)

- farming: remained flat on the previous year, USD 604 mln (FY2019: USD 602 mln)

According to the company's report, key leverage metrics for FY2020 ended up at 2.2x Net debt / EBITDA, 1.6x Adjusted net debt / EBITDA, and 3.0x EBITDA / interest coverage.

"We are happy with the resilient business performance in this challenging season. African swine fever, continuing US-China trade tensions, production oversupply and political instability, and finally, COVID-19 pandemic — all these factors have made agricultural markets very turbulent," the Chairman of the Board of Directors and Founder Andrei Verevskiy says in a statement.

He notes that the relative weakness of the farming business was offset with an outstanding performance of oilseed processing and infrastructure and trading segments. Despite significant volatility, global prices for sunflower oil in FY2020 were generally higher than a year ago, which positively impacted profits captured by Ukrainian farmers and crushers. And given a record 16.5 mln t sunflower seeds harvest in Ukraine combined with muted crushing capacities growth, competition among processors for oilseeds reduced, which allowed Kernel to secure strong USD 100 EBITDA margin per ton of sunflower oil sold, Andrei Verevskiy adds.

With 1.5 mln t of sunflower oil sales, the segment generated USD 152 mln EBITDA in FY2020, up 39% YoY.

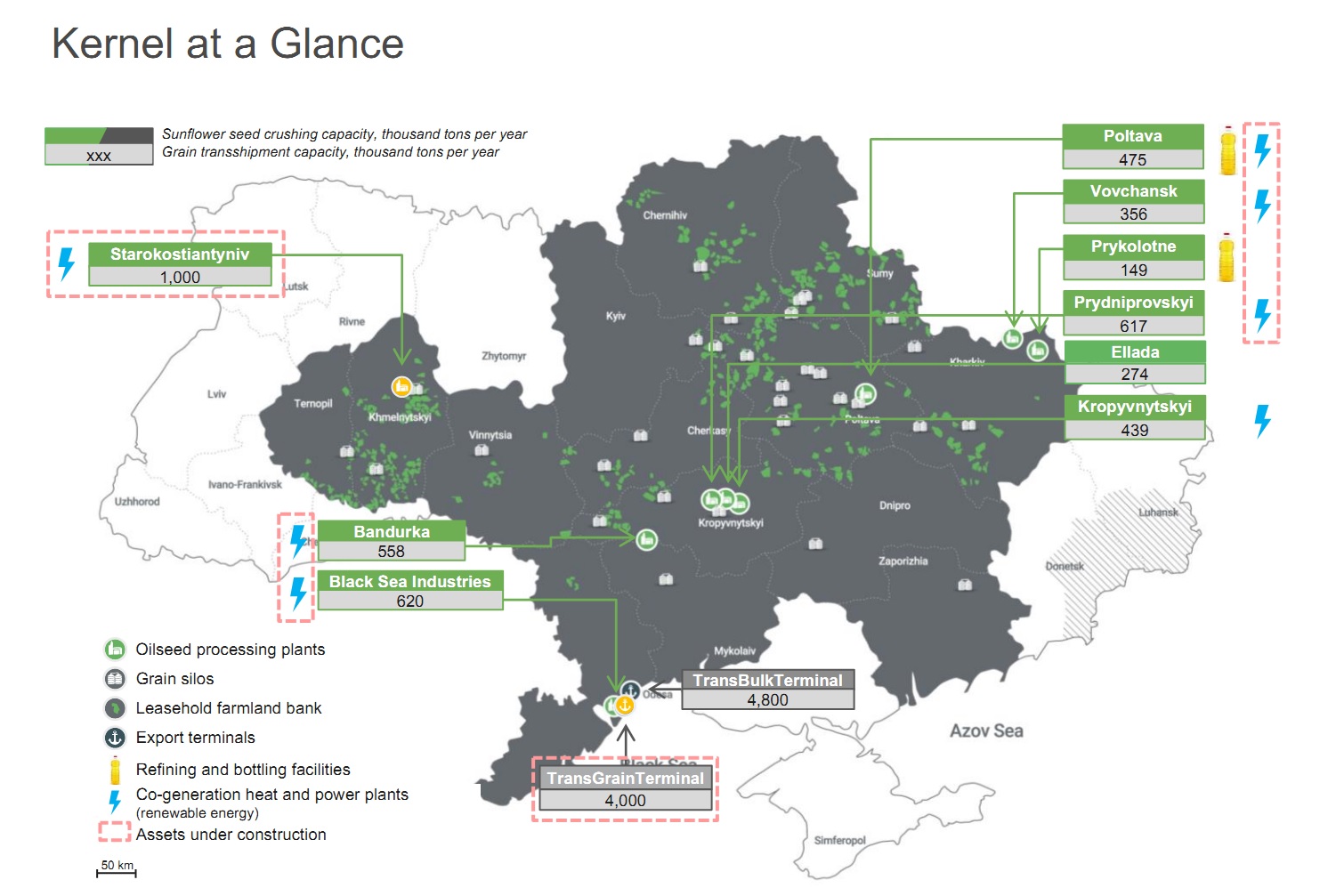

"Our terminals handled 6.7 mln t, up 45% as compared to last year, enhanced by the launch of the operations on our new TransGrainTerminal," the Kernel Chairman comments.

In addition, the company benefitted from its last year investment in grain railcars. As stated by Andrei Verevskiy, an overheated market allowed Kernel to save USD 38 mln on transportation costs, which fully justifies this investment in the railcar business last year.

In his statement, Andrei Verevskiy also commented on the land market liberalization in Ukraine, saying that FY2020 will go down in history as the year when Ukraine finally adopted the longawaited land market reform, although in quite a restricted format. The final design of the reform implies no corporate investments in land acquisition until 2024, therefore Kernel does not envisage any investments into land purchases by that time, he states.

Previously reported that Fitch affirmed Kernel Holding S.A.'s Long-Term Foreign- and Local-Currency (LC) Long-Term Issuer Default Ratings (IDR) at 'BB-'. The Outlook is Stable.