Earthquake: How Top 10 Latifundist List Shook and Changed in 5 Years

While updating the Top 100 list of Ukrainian Latifundists, Latifundist.com has discovered that more than 100 agriculture companies cultivate no less than 15 thous. ha of land with more than 10 of them working on 100+ thous. ha.

Apart from that, three of the domestic agroholdings are included in the Top 35 Largest World Latifundists 2017 based on their land bank: UkrLandFarming (570 thous. ha), Kernel (560 thous. ha), Myronivsky Hliboproduct (370 thous. ha).

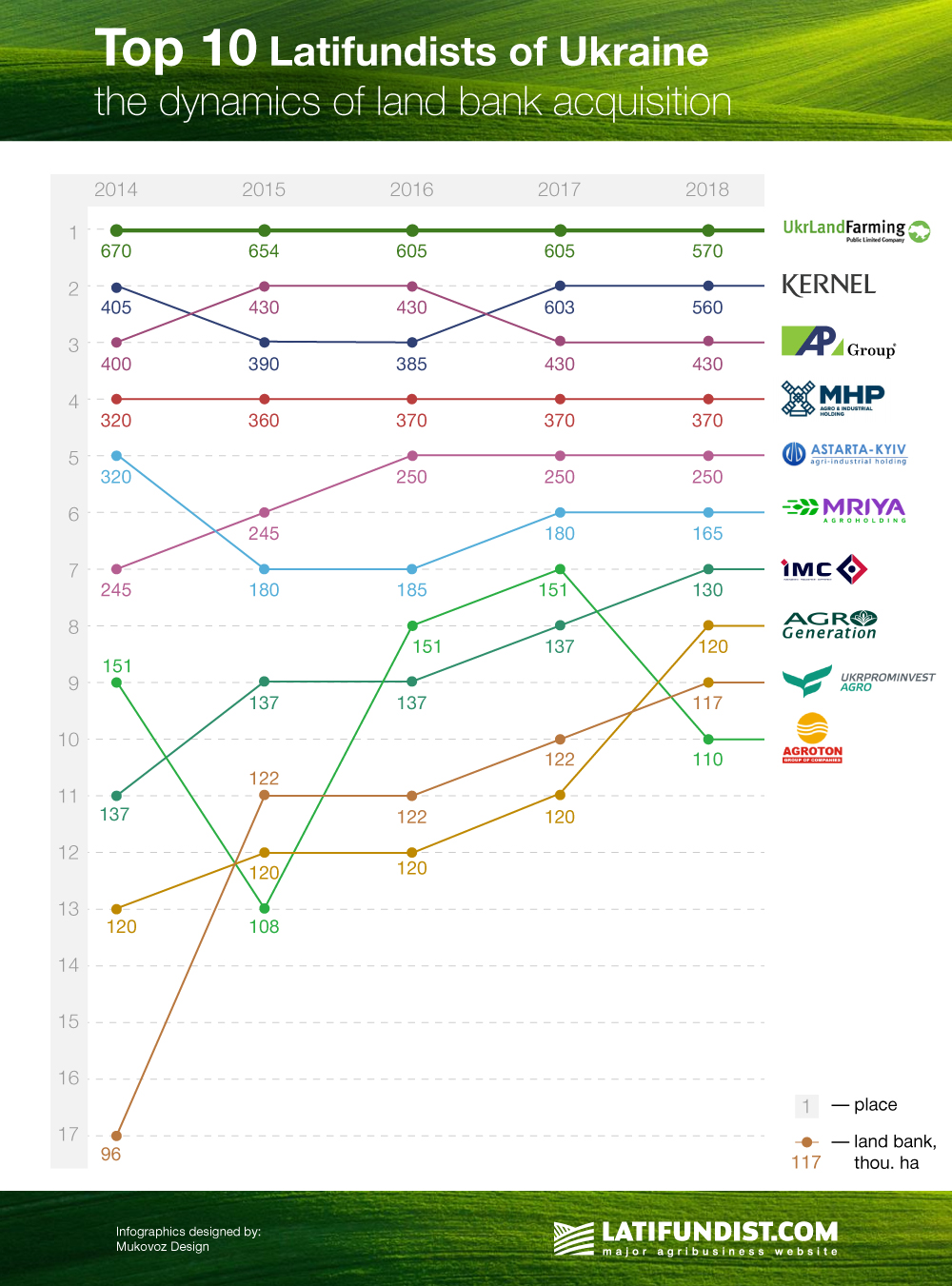

The past 5 years exhibited a significant shift in the balance of power of the 10 largest Latifundists of Ukraine. We have checked our archives to see how the land banks of the agroholdings changed during those years: which holdings gained or lost hectares, and which holdings have perished for good.

Aiming at optimization

Many owners and top-managers of large agroholdings in Ukraine remark that increasing the land bank is not a number one priority. For instance, Yuri Kosyuk, the owner of the Myronivsky Hliboproduct agro-industrial holding, once remarked that his company aims to focus on implementing IT and renewable energy into the production processes while increasing land bank comes third on the company’s priority list. However, in its 2016 non-financial report the company spelled out plans to increase its land bank to 550 thous. ha in 3-5 years.

Kernel, on the other hand, stuck to its plans of optimizing the land bank to 560-600 thous. ha and announced of the increase in the latest investor presentation of the company. According to Yevgeny Osipov, CEO of the agroholding, such a model allows effective management of assets in terms of logistics and production.

Related story: No Monopoly Is Present in the Market of Soybean Processing and Export

In early 2018, Kernel shot up the Top 100 Latifundists of Ukraine after the 5-year-in-a-row leader UkrLandFarming cut down 605 thous. ha of its landbank to 570 thous. ha. The owner of UkrLandFarming Oleg Bakhmatyuk mentioned that the decrease was accounted for by various reasons: in some cases, the holding let go of the land because it did not bring the desired profit, in other cases, the land was lost to competitors. Currently, the company is aiming to enhance the efficiency of land cultivation in the fields it still works on.

While the largest latifundists of Ukraine went on an improvised land diet, another land player has entered the market. For the past 2-3 years, the owner of the hypermarket chain Epicenter Alexander Gerega has been steadily growing the company’s land bank. The latest reports, however, prove that land is not Mr. Gerega’s sole interest. According to the analytical system YouControl, his share in the Chumak company amounts to 24% which is indicative of his interest in agricultural processing plants.

At the moment, the MP’s company Epicenter and its affiliated offshores have gained control over the agricultural enterprises with the total land bank of 166 thous. ha. Therefore, Epicenter Agro (one of the likely names for the agro holding) has come very close to competing with the ten largest latifundists of Ukraine. Despite that, the manager of the agricultural division of Epicenter K Vitaliy Stavnychuk claims that the company’s aim lies in the efficient usage of the already cultivated land and not in acquiring the maximum amount of assets.

5 Years in retrospect

During the past 3 years, the same five companies dominated the top positions of the Top 100 Latifundists of Ukraine. However, the positions of the companies down the list were less stable. A look 5 years back reveals drastic changes in the Top 10. On the one hand, they are due to the large holdings losing plants and lands on the territories of the annexed Crimea peninsula and the occupied Donbass. On the other hand, the shift occurred because many companies left the market.

Let us observe the changes happening to the top ten largest latifundists over the past 5 years.

In 2014-2016, the Top 10 listed such companies as Ukrainian Agrarian Investments and Sintal Agriculture whose land bank was over 150 thous. ha each. The assets of the former (together with its leasing rights for 190 thous. ha of land) were bought by Kernel which it partially sold to a subsidiary of the Dutch agroholding Goodvalley Ukraine. Little is known of the fate of the latter company except that Sintal D, the managing company of the holding, was announced bankrupt according to the ruling of the Commercial Court of the Kharkiv region of 29.03.2016 followed by the commencement of liquidation proceedings. According to Nikolay Tolmachev, the former owner of Sintal Agriculture, the company currently has zero land bank but its leasing rights are listed under other legal entities. We may only guess who those legal entities are.

Fearing the launch of the farmland market

The closer the inevitable launch of the farmland market is, the harder agroholdings try to optimize their land banks. It is true that optimization is partly driven by a desire to increase the profit derived from 1 ha. On the other hand, the holdings need to secure/earn their lessors’ loyalty for when the moratorium is (hopefully) lifted.

The Ministry of Agrarian Policy and Food of Ukraine estimates that the launch of the land market will result in latifundists losing 20% of the total land bank, even though the loss will not happen overnight. Maxim Martynyuk, the First Deputy Minister of Agrarian Policy and Food of Ukraine, has remarked that farmland sales prohibition is, in fact, more profitable for the agroholdings since it reduces their production costs.

For whom the bell tolls

But the law of conservation still applies. Although the land market promises new vistas for small and medium-sized agribusiness, the current state of arts with farmland ownership (or rather the leasehold ownership) reminds of Brownian motion when ownership passes to those who have money, power, and, very often, their own land bank.

The events of the recent months illustrate this perfectly well. For instance, the Eridon group of companies has acquired the assets of Kyiv-Atlantic Ukraine and increased its land bank by 8 thous. ha. Earlier, LNZ Group confirmed the acquisition of all the corporate rights of Shpola-Agro Industry (with the land bank of 15 thous. ha). Around the same time, the land bank of Cygnet Agrocompany has increased by 5.5 thous. ha following its acquisition of the assets of Ruzhinsky Krai.

The trend for relatively small acquisitions of 5-15 thous. ha has been challenged in early July by the confirmed news of another much larger acquisition. An international investment company has issued an official offer for acquiring the assets of the Mriya Agroholding whose land bank is 165 thous. ha.

According to Latifundist.com information, the buyer is Continental Farmers Group. The group owns a couple of agricultural assets in Western Ukraine: Agro LV Limited and Agromark UK.

It is obvious that by the end of the year there will be more changes to the Top 100 Latifundists of Ukraine list. Stay with us and be the first to know about those changes and their scale.

Aleksei Beskletko, Latifundist.com